Financial markets 28/10/2025

Despite the ongoing U.S. government shutdown, last Friday we finally learned the CPI data corresponding to September. These figures came in better than analysts’ forecasts, which once again encouraged investors to lean toward buying. A growth of 3.1% was expected for both headline CPI and core inflation, but both came in at 3%. This generated enough optimism to conclude that price developments might be less problematic than previously thought, giving the Federal Reserve enough room to continue with its recently initiated process of interest rate cuts. In any case, the backlog of U.S. macroeconomic data is significant, and we could see less positive readings for investors in the coming weeks.

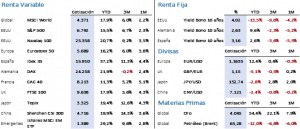

Equity markets closed the week higher, with gains of around 2% in the United States and 1.25% in Europe. The S&P 500 ended the week up 1.92%, closing at 6,791.73 points after marking a new all-time high at 6,807.06. The Nasdaq 100 showed a similar trend, rising 2.18% and setting a record high of 25,418.64 points before closing at 25,358.16. The Euro Stoxx 50 gained 1.18%, closing at 5,673.65 points, also reaching a new all-time high of 5,699.45. Meanwhile, the Ibex 35 rose 1.64%, ending at 15,857.40 points — less than 1.5% away from its historical high dating back to November 2007.

In fixed-income markets, despite some volatility throughout the week, closing prices reflected only minor changes. The 10-year Treasury yield fell by 1 basis point to 4%, supported by the CPI data that bolstered expectations for further rate cuts. In Europe, the outlook is different: there are currently no expectations for rate cuts on the ECB’s horizon. The Bund closed with a yield of 2.63%, up 4 bps from the previous week, while the Spanish bond ended at 3.16%, a 5 bps increase. Unless geopolitical factors interfere significantly, this upward move could continue in the coming days.

Alternative markets experienced a change of pace. Gold fell 2.06%, closing at USD 4,126.5/oz. This correction broke a nine-week streak during which gold had gained more than 30%. The sharp rise of recent months and reduced political pressure could explain this small pullback. It’s worth noting that between the week’s high and low, gold moved by more than 9%, signaling a certain increase in the metal’s volatility.

Meanwhile, oil rebounded from recent monthly lows, with Brent crude closing up 7.42% at USD 65.84/bbl. The main drivers behind this rally were U.S. sanctions on Russia’s two largest oil companies (Rosneft and Lukoil), which together account for 5% of global production. The immediate reaction was China canceling crude purchases—at least in the short term—and India announcing a reduction in imports of Russian oil. On another front, the upcoming meeting between Xi Jinping and Donald Trump this week brings uncertainty. Additionally, some OPEC countries have offered to increase production to offset the reduced Russian supply, a move that could strain OPEC+ relations. Finally, several international institutions forecast a crude oil oversupply by 2026, ranging from 2.3 million bpd (J.P. Morgan) to 4 million bpd (IEA estimates). In any case, current price tension is the result of short-term decisions, but everything points to Brent potentially falling below USD 60/bbl by 2026.

This week’s macroeconomic data reinforced the view of a positive trend in the economies of China and Europe. In China, GDP was expected to slow to 4.7%, but the official figure came in at 4.8%. Additionally, industrial production rose to 6.5% from 5%, and the unemployment rate improved by one-tenth to 5.2%. In Europe, PMI data exceeded forecasts, particularly in the services sector, which rose to 52.6 from the expected 51.2. In the U.S., besides the CPI data, PMIs also showed a similar improvement to Europe’s. Finally, it’s worth noting that soft data (reflecting future expectations) remain quite pessimistic, while hard data (actual published figures) continue to show economic strength—suggesting that market corrections are unlikely except those triggered by political actions.

This week, we’ll be watching China’s PMIs, Europe’s GDP, unemployment rate, and CPI, and the U.S. PCE, but most importantly, we’ll focus on comments from ECB and Fed governors, as both central banks meet this week to review their monetary policy interest rates. Consensus expects the ECB to remain unchanged at 2%, while the Federal Reserve is anticipated to cut by 25 bps to 4%.

Quote:

We close with the following quote from Dale Carnegie, American businessman and writer. Carnegie was a promoter of what is now known as the principle of personal responsibility:

“You can make more friends in two months by becoming interested in other people than you can in two years by trying to get other people interested in you.”

Summary of the performance of major financial assets (10/27/2025)