Financial Markets

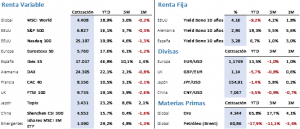

Slight declines in stock markets last week, with a special mention for technology stocks, which were the hardest hit by selling pressure. The Ibex 35 once again moved against the tide in an exceptional year that is set to close with gains of over 40%, having once more broken its all-time high, now set at 17,035.44 points.

The week was marked by the final Federal Reserve meeting of the year. As expected, the Fed cut rates by 25 basis points for the third time in 2025, leaving the benchmark interest rate in the 3.50%–3.75% range. In its subsequent comments, and especially in its review of the main macroeconomic variables, it presented a less negative outlook for the economy. This has led the market to price in only one additional 25 bp rate cut throughout 2026. This shift in expectations has been the main driver behind the recent rise in long-term bond yields, beyond the structural issue of high public deficits affecting major economies such as France and the United States.

U.S. GDP is expected to grow by 2.3% in 2026, which is 0.5% higher than the Fed projected in September. In addition, the unemployment rate is expected to remain at current levels (4.4%), while both inflation and the PCE will ease compared to previous estimates, ending 2026 closer to 2% than to 3%. If the United States improves its forecasts, it would be logical to see improvements in other markets as well, which would be positive for equities. However, it is most likely that over the coming months we will continue to see meaningful adjustments in forecasts for both employment and inflation (the two indicators under the Fed’s mandate), a situation that could lead to erratic market movements.

The S&P 500 closed Friday down 0.63% at 6,827.41 points, while the Nasdaq 100 fell 1.93% to finish at 25,196.73 points. In Europe, the Euro Stoxx 50 barely slipped 0.14% to 5,715.95 points, although it did correct on Friday dragged down by the U.S. markets. The Ibex 35 closed at 16,854 points with a gain of 0.99%. It is also worth highlighting Ferrovial’s entry into the Nasdaq 100 index after two years of trading in the United States.

In government bond markets, the change in expectations for U.S. interest rates triggered widespread increases in yields, of around 6 basis points. As a result, the 10-year Treasury stood at 4.20%, compared with 2.86% for the Bund and 3.32% for the Spanish bond. This means yields have risen by more than 20 basis points in less than three weeks, which could generate some volatility before the new levels are consolidated in the market.

Regarding alternative markets, gold rose again and, after several weeks without doing so, set a new all-time high at USD 4,387.30 per ounce, gaining 2% over the week. Brent crude fell to the area of recent lows at USD 61.12 per barrel, opening the door to annual lows and the USD 55 per barrel level, which is the first target identified by oil analysts. These corrections contrast with the tightening of measures against Russia and the countries buying its oil, as well as with higher global growth estimates for 2026.

From a macroeconomic perspective, highlights from the past seven days include an improvement in Chinese exports, which grew by 5.9% in November, and an increase in CPI to 0.7%. This rise could be temporary, as it was driven by higher agricultural prices due to poor weather conditions. In the United States, the most relevant data after the Fed meeting was job creation (JOLTS), which rose sharply to 7.67 million from the previous 7.2 million. However, a closer look suggests the figure may be less solid than it appears, as both voluntary quits—clearly down—and layoffs—clearly up—point to a labor market that is weaker than the headline number suggests.

For the current week, attention will focus on industrial production and the unemployment rate in China. In Europe, we will see the November PMIs, industrial production figures, CPI data, and a meeting of the ECB, which once again is expected to leave its monetary policy unchanged. Finally, in the United States, PMIs will be released, along with October retail sales, November non-farm payrolls—key to understanding the true state of the labor market—and the November CPI and October PCE data.

The quote:

And we close with the following quote from Scott Hamilton, the American Olympic figure skater who has faced significant health challenges, including a childhood illness that affected his growth, testicular cancer, and a recurring benign brain tumor:

“The only disability in life is a bad attitude.”

Summary of the performance of major financial assets (15/12/2025)