Financial Markets 27/01/2026

Market Insights:

Stock markets experienced a week that started slowly but steadily improved, marked by decisions from the US government. Over the weekend, the US announced a 10% tariff increase on European assets, effective February 1st, if it did not allow the purchase of Greenland. The market reaction was predictably negative, with declines in fixed-income and equities, and notable gains in safe-haven assets such as the Swiss franc and precious metals, which reached new all-time highs. But, as is his custom, the US president reversed his decision, using the Davos forum as the backdrop for the announcement. This led to a return of money to the markets and a recovery of some of the losses incurred in the first days of the week. As we have been saying for weeks, 2026 could be a good year for financial assets, but we are going to encounter many problems like those experienced last week. Volatility is here to stay this year, and we will have to learn to live with it.

A second factor that altered the expected course was the macroeconomic data. For example, in China, export and import figures clearly grew more than the market anticipated. The import figure was particularly noteworthy, reaching 5.7% compared to an estimate of 0.9%. The conclusion is that the Chinese economy continues to function at its own pace and the trade war is not taking its toll. In Europe, industrial production figures stood at +0.7% month-on-month, above the 0.5% forecast, reinforcing signs of a gradual recovery in the European economy. Furthermore, the minutes of the last European Central Bank meeting confirmed this sentiment, as the ECB revised its GDP growth forecasts for 2026 and 2027 upwards by two-tenths of a percentage point, to 1.2% and 1.4%, respectively. Regarding inflation, they expect it to continue moderating and follow the established path, which would bring core inflation to 1.9% in 2027. However, they conclude that if it does not moderate at the appropriate pace, it would mean that monetary policy is not sufficiently restrictive, which could translate into an increase in interest rates. Finally, in the United States, the December CPI figure confirmed the decline seen in November and settled at 2.7%. The housing market experienced one of its best weeks thanks to mortgage rates approaching 6%, a level not seen in several years. And, as in Europe, industrial production data exceeded forecasts. Furthermore, the labor market continues to slightly improve week after week on expert predictions.

In the stock markets, geopolitical risk ultimately outweighed the positive macroeconomic outlook. The S&P 500 fell 0.35% for the week, closing at 6,915.61 points, while the Nasdaq 100 recovered all of its losses, gaining 0.30% to finish the week at 25,605.47 points. Behind this recovery in the technology sector could be the possibility that China will soon authorize major tech companies to purchase Nvidia chips. In Europe, the losses were greater, as European companies were the most affected by the announced tariff increases. The Euro Stoxx 50 dropped 1.26%, closing at 5,953.06 points, very much in line with the performance of the German DAX. In Spain, the Ibex 35, although it performed somewhat better, did not escape losses, falling 0.94% to end the week at 17,544.40 points. Meanwhile, fixed-income markets saw selling take hold, leading to higher yields. Initially, the selling was driven by a flight to safe-haven assets due to fears of increased tariffs. Subsequently, the positive economic outlook diminished the likelihood of short-term interest rate cuts, further contributing to the rise in yields. The Treasury yield experienced a back-and-forth movement, ultimately closing at 4.24%, 1 basis point above the previous week’s yield. The Bund rose 6 basis points and the Bond 5 basis points, ending the week at 2.90% and 3.27%, respectively.

The impact on commodity markets was once again significant. Increased uncertainty leads to higher volatility, which in turn triggers defensive buying of gold and silver. Precious metals reached new all-time highs, with silver trading above $100/oz and gold nearing $5,000/oz, closing at $4,979.70/oz, an 8.36% increase. Meanwhile, Brent crude rose again to $65.88/bbl, a 2.73% gain, driven by the sharp decline of the US dollar, which fell 2% against the euro, ending the week at an exchange rate of 1.1828 EUR/USD. Among the key economic indicators to watch over the next seven days are the following: in China, the Purchasing Managers’ Index (PMI); in Europe, the preliminary GDP figures for Q4 2025 and the unemployment rate; and in the United States, the durable goods orders data, the Conference Board survey, and the Federal Reserve meeting.

We are currently in the midst of the earnings season for the fourth quarter of 2025. As of last Friday, 64 companies had reported, 69% of which exceeded earnings estimates, which stand at 17.1% compared to the initially projected 8.8%. Nearly 100 companies will report their results this week, including Apple, Microsoft, Tesla, and Meta.

Quote: And we leave you with this quote from the English writer Charles Dickens: “No one who has relieved the burden of his fellow man has failed in this world.”

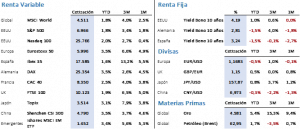

Summary of the performance of major financial assets (January 26, 2026)

This report does not provide personalized financial advice. It has been prepared independently of the specific financial circumstances and objectives of the individuals who receive it.

This document has been prepared by Portocolom Agencia de Valores S.A. for the purpose of providing general information as of the date of issuance of the report and is subject to change without prior notice. Portocolom Agencia de Valores S.A. assumes no obligation to communicate such changes or to update the content of this document. Neither this document nor its content constitutes an offer, invitation, or solicitation to purchase or subscribe to securities or other instruments, or to make or cancel investments, nor may it serve as the basis for any contract, commitment, or decision of any kind.

The information included in this report has been obtained from public sources considered reliable, and although reasonable care has been taken to ensure that the information included in this document is neither uncertain nor ambiguous at the time of publication, we do not represent that it is accurate or complete and it should not be relied upon as such. Portocolom Agencia de Valores S.A. assumes no responsibility for any direct or indirect loss that may result from the use of the information provided in this report. Past performance of variables may not be a good indicator of their future outcomes.