Financial Markets 23/9/2025

Another positive week for equity markets, supported in this case by strong macroeconomic data and the Fed’s decision to cut interest rates by 25 basis points, leaving the door open for further cuts in the coming months. Overall, macroeconomic factors were the main driver of the stock markets, as the Fed’s decision was fully priced in by the market. In China, industrial production data (+6.2%) continues to show the strength that will allow the economy to return to growth above 5% in 2025. On the other hand, we saw a gray tone in the unemployment rate, which rose one-tenth of a percentage point to 5.3%, but it is still at very comfortable levels for the authorities, given the weakness of domestic demand and the consequences of the tariff war. In Europe, industrial production grew by 0.3%, but the previous figure was revised from -1.3% to -0.6%, and on the other hand, ZEW investor confidence rose against forecasts to 26.1. The CPI figure remained at 2% (2.1% estimated), as did the underlying figure at 2.3%. Finally, in the United States, we highlight the retail sales figure, which grew by +0.7%, showing that consumer spending has not yet been affected, the weekly jobless claims data, which exceeded market forecasts, the Atlanta Fed’s GDP forecast for Q3 2025, which stood at 3.3%, and the Philadelphia Fed manufacturing index, which jumped to 23.2 from -0.3 previously and 1.7 forecast.

The impact of all this news was reflected in the main indices, which rose, in some cases reaching new all-time highs, such as the S&P 500, which after touching 6,671.82 points closed the week at 6,664.36, up 1.2%. The Nasdaq 100 followed suit at 24,641.93 points, closing at 24,626.25 points, up 2.22%. In Europe, the Ibex 35 bucked the upward trend and closed virtually unchanged at 15,314.30 points (moreover, from a technical point of view, if it does not exceed the highs set during the week, we could see a correction in the short term). In contrast, the Euro Stoxx 50 followed the US indices, gaining 1.28% to close the week at 5,459.55 points.

The downside of these positive macroeconomic figures was reflected in the bond market, which saw yields rise as forecasts for the next moves by central banks were adjusted, albeit minimally. The 10-year Treasury yield rose by 8 basis points to 4.14%, while the Bund rose by 4 basis points to 2.75% and the Bono barely changed, closing at 3.30%, but with more than 12 basis points between the week’s high and low.

Where things have not changed much is in the alternative markets. Gold rose again, reaching a record high (USD 3,743.67/oz) and closing at USD 3,719.05/oz, a rise of 0.94% over the week. Brent crude fell just 0.52% to close at $66.64/bbl, with the market continuing to analyze the price level that would balance current crude oil supply and demand with changing global economic growth forecasts. In any case, a rebound in prices from current levels could push up inflation, especially in Europe, as current prices are not too different from those of 12 months ago.

This week will not be marked by any significant macroeconomic indicators that could significantly alter the course of the markets, but we should keep an eye on the following data: i) in China, the benchmark interest rates for one- and five-year loans, ii) in Europe, the ECB’s economic bulletin and the provisional PMI data for September will be published, for which minimal improvements are expected, and iii) in the United States, the final GDP data for Q2 2025 (+3.3%) will be released, data from the University of Michigan survey on inflation expectations and consumer confidence, provisional PMIs for September, and most importantly, the PCE for August, a key indicator used by the Fed to understand the future behavior of inflation in the United States.

The Quote:

And we bid farewell with the following quote from Johann Wolfgang Von Goethe, German playwright, novelist, poet, philosopher, and naturalist, considered the greatest and most influential writer in the German language: “What matters most should never be at the mercy of what matters least.”

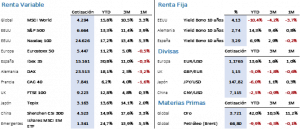

Summary of the performance of major financial assets (22/9/2025)

This report does not provide personalized financial advice. It has been prepared independently of the specific financial circumstances and objectives of the individuals who receive it.

This document has been prepared by Portocolom Agencia de Valores S.A. for the purpose of providing general information as of the date of issuance of the report and is subject to change without prior notice. Portocolom Agencia de Valores S.A. assumes no obligation to communicate such changes or to update the content of this document. Neither this document nor its content constitutes an offer, invitation, or solicitation to purchase or subscribe to securities or other instruments, or to make or cancel investments, nor may it serve as the basis for any contract, commitment, or decision of any kind.

The information included in this report has been obtained from public sources considered reliable, and although reasonable care has been taken to ensure that the information included in this document is neither uncertain nor ambiguous at the time of publication, we do not represent that it is accurate or complete and it should not be relied upon as such. Portocolom Agencia de Valores S.A. assumes no responsibility for any direct or indirect loss that may result from the use of the information provided in this report. Past performance of variables may not be a good indicator of their future outcomes.