Financial Markets 30/9/2025

The beacon of the markets:

Last week could be described as one of consolidation in the financial markets after the good results obtained throughout the month. On Monday, the S&P 500 reached a new all-time high, which was broken early on Tuesday, settling at 6,699.52 points, before three consecutive sessions of corrections began, driven by high valuations and important macroeconomic data released on Thursday and Friday. The GDP data for Q2 2025 surprised with a significant rise to 3.8% from the preliminary 3.3%, which was further reinforced by the Atlanta Fed’s forecast for the third quarter ending today, September 30, placing GDP growth for Q3 2025 at 3.9% on a provisional basis. The second relevant piece of data and catalyst for last Friday’s rises was the PCE, which was in line with market estimates and indicates some inflationary pressure but still no risk of a significant rebound, in line with market forecasts.

The stock markets reflected the macroeconomic data without major changes in their main indices, awaiting the US employment data that will be released throughout the week: JOLTS, ADP, and “Nonfarm Payrolls,” along with the unemployment rate, which will be published on Friday, October 3, All of this comes just days before the start of the third-quarter earnings season, for which forecasts have been improving over the last few weeks. With all this in mind, the S&P 500 fell 0.31% to close at 6,643.70 points, very much in line with the Nasdaq 100, which ended the week down 0.51% at 24,503.85 points. In Europe, the markets performed similarly but closed Friday in the green, with the Euro Stoxx 50 gaining +0.72% to end at 5,497.65, less than 2% below the high set in March. The Ibex 35 rose 0.58% to close at 15,350.40 points, also close to its annual highs.

In line with the stock markets, the bond market experienced a week of transition, with the biggest movement seen in the 10-year Treasury, whose yield rose 5 bps during the week to close at 4.19%. In Europe, the Bund remained stable at 2.75% and the Bono rose 1 bp to 3.31%. In a week without many macroeconomic references, those that were published reaffirmed that the economy remains in good shape on both sides of the Atlantic. Although it seems clear that interest rates in Europe will remain stable at current levels for many months to come, the market’s expectations of Fed rate cuts are beginning to be called into question. It is very likely that we will see a further 25 bp cut in October, but for the December meeting, the final decision will be based on macroeconomic data, especially inflation and the labor market, which, although under pressure, do not show an alarming level of stress. The probability of a 25 bp cut has fallen below 70%.

Where everything remains the same is in the precious metals markets, where gold, silver, and platinum continue to reach record highs, on the one hand, as safe-haven assets and, on the other, because at the industrial level, the decoupling between production capacity and demand is becoming very evident. Gold rose 2.26% during the week after hitting a new all-time high of $3,808/oz and closing at $3,789.45/oz. Yesterday, Monday, it once again exceeded its high. Brent crude continued to trade in a controlled range between $65/bbl and $70/bbl, closing on Friday at $69.67, up 4.48%, but forecasts of a further increase in crude oil production by OPEC+ from November could put downward pressure on crude oil prices again.

On the macroeconomic front, we will see several indicators of relevance to investors throughout the week. Beyond the US employment data, which will undoubtedly be the benchmark for the markets, we highlight the PMI data in China, Europe, and the United States. Finally, it should be noted that Chinese markets will be closed from Wednesday onwards, that CPI and unemployment rate data will be released in Europe, and that The Conference Board’s consumer confidence data will be published in the US.

The quote:

And we bid farewell with the following quote from Benedict XVI, Joseph Alois Ratzinger, the 265th pope of the Catholic Church: “Where morality and religion are reduced to the exclusively private sphere, the forces that can form a community and keep it united are lacking.”

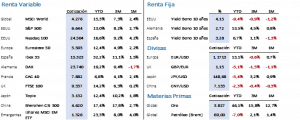

Summary of the performance of major financial assets (29/9/2025)

This report does not provide personalized financial advice. It has been prepared independently of the specific financial circumstances and objectives of the individuals who receive it.

This document has been prepared by Portocolom Agencia de Valores S.A. for the purpose of providing general information as of the date of issuance of the report and is subject to change without prior notice. Portocolom Agencia de Valores S.A. assumes no obligation to communicate such changes or to update the content of this document. Neither this document nor its content constitutes an offer, invitation, or solicitation to purchase or subscribe to securities or other instruments, or to make or cancel investments, nor may it serve as the basis for any contract, commitment, or decision of any kind.

The information included in this report has been obtained from public sources considered reliable, and although reasonable care has been taken to ensure that the information included in this document is neither uncertain nor ambiguous at the time of publication, we do not represent that it is accurate or complete and it should not be relied upon as such. Portocolom Agencia de Valores S.A. assumes no responsibility for any direct or indirect loss that may result from the use of the information provided in this report. Past performance of variables may not be a good indicator of their future outcomes.