Stock markets are bull markets in the long term

By Oscar Tejada

There is a maxim among equity managers that one should not position oneself against

the prevailing market trend. Trying to anticipate when a trend reversal will occur

(selling at a cycle high or buying at a cycle low) may work out well once, but the reality

is that in the long term, not being invested is an opportunity cost that reduces the returns achieved

by the investor.

That said, it should be borne in mind that financial markets are cyclical and that, as they

are made up of different industrial sectors and diverse geographies, each with its own

characteristics, professional managers can position their portfolios according to both the

economic cycle and their clients’ risk profiles. This is what is known as active capital management.

In other words, we must always remain invested, but that does not mean that

it always has to be in the same assets or in the same amount.

The reason for this introduction is due to the very common temptation among non-professional investors

to sell positions that generate profits without taking into account that these

could continue to increase, since there are many factors that determine the value of each

financial asset, and keeping them all under control is a very complicated task. Over the last year, we have become accustomed to hearing and reading in the specialized media that

US assets are very expensive, but, on the contrary, their main indices have continued to rise.

For example, the S&P 500 has risen by more than 39% since its low on April 7.

If we had paid attention to this information, the revaluation of our portfolios would be significantly lower than what we have

currently. If we had paid attention to this information, the

appreciation of our portfolios would clearly be lower than what we have

currently.

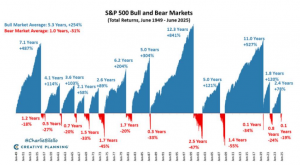

The attached chart shows the bull and bear cycles of the last seventy-five years,

where it can be seen that the market has been rising in more than 80% of the sessions.

The conclusion is that adjustments can and should be made to the weights of the different The conclusion is that adjustments can and should be made to the weightings of the different

asset classes that make up a portfolio, mainly fixed income and equities,

but never completely exit the market.

In those seventy-five years, we have experienced twelve bull markets and twelve bear markets. The former,

with an average duration of more than five years and a revaluation of 254%, in contrast, the

declines have lasted much less, around a year, and have caused average capital losses of

31%. What is certain is that if we had left the market in the midst of a correction, we would have

missed out on a significant part of the subsequent rise.

The market tracks numerous data points in an attempt to understand what will happen to stocks

in the short, medium, and long term, in order to position investments in line with

the analysis of that data. Most indicators are financial in nature: some are

macroeconomic, such as inflation forecasts, labor market performance,

consumption, or central bank decisions on interest rates. Others are

microeconomic, such as corporate earnings, the level of corporate leverage,

or the impact of executives on future business decisions.

There are other external factors, which we call geopolitical, such as

armed conflicts, unilateral political decisions (tariffs), or lack of management capacity

(government in France). But what they all have in common is that they alter the course

of stock market indices through corrections or sharp rises that can last from a few

days to even several years.

The latter are the most complex to measure and predict, since throughout the trend

there are many signs that it has run its course, but any small

correction is enough to resume its march. The last major trend

was experienced from 2009 to 2020, a period in which the S&P 500 did not experience a

minimally noteworthy correction, which meant that after 11 years of growth, the index generated

a 527% revaluation.

In recent years, we have been experiencing a similar phenomenon with gold. From October 2022

to today, gold has appreciated by more than 140%, reaching unprecedented prices. In 2024,

experts believed that, according to the law of supply and demand, an ounce of gold was not worth more than

USD 2,500, but factors have emerged that have led the precious metal to exceed

$3,900 per ounce. Among these factors is the People’s Bank of China, which, together with other

central banks, has decided to significantly increase the weight of gold in its strategic reserves

(to reach the weight of gold in the reserves of the United States or some

other European country, it would have to continue buying the current volumes for several more years).

Other reasons for the rise can be found in the weakness of the USD or the process of lowering

interest rates, especially by the FED, and all this without forgetting that every time

an international conflict arises, especially one involving armed confrontation, the power

of gold as a safe-haven asset resurfaces.

These inherent market factors (macroeconomic) together with external factors (political)

continuously alter the future of the stock markets, and making decisions about whether or not to invest

based on each of these data points systematically leads to mistakes, even if we may

have some great successes.

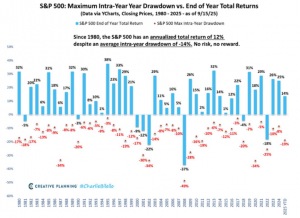

Finally, one more example of the importance of being invested: the chart above shows the

return generated by the S&P 500 each year since 1980 (blue bars) and the maximum annual decline

in percentage terms from a previous high (red dots). Over the last 45 years, the main US index

has appreciated by an average of 12% annually, having suffered an average maximum year-on-year decline

of 14%, which reaffirms the idea that occasional declines, although

significant, are short-term movements that do not alter long-term results.

Of course, there is no question about the importance of the timing of an investment,

but no one can guarantee that when new capital is received for investment, it will be the

most opportune moment to do so. A clear example: anyone who received new capital for investment

last February would have done so at historic highs and would now have a

cumulative profit of close to 10%. But if that capital had been invested on April 7, the capital gain would have been

as high as 39%. It is up to the manager to decide how to invest that new

capital to achieve the highest possible return, without ever forgetting the risk profile of each

individual client.