Financial Markets 21/10/2025

The main aspect we can highlight from the financial markets over the past week was the significant upturn in volatility. External factors are affecting market performance and decision-making by managers. On the one hand, the US government shutdown continues, leaving us without macroeconomic data to guide us on the real state of the economy. On the other hand, we are witnessing a second chapter in the war of words between the United States and China, with just a few weeks to go before the deadline they set themselves to reach a trade agreement. It is true that the market recovered within 24 hours, but in the face of so much noise, managers’ caution is becoming more noticeable. Finally, on Thursday, the bankruptcy of two regional US banks was announced, causing a sharp increase in volatility and significant market declines, but these lasted only a few hours, as it was considered an isolated event and offset by the very good data presented in recent days by the major US banks.

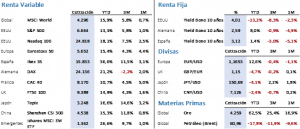

Given this scenario, it would have been logical to see declines in equities, but the start of the earnings season has been very positive and is helping the indices remain close to their historic highs. The S&P 500 rose 1.7% to close at 6,664 points, while the technology sector rose even more, with the Nasdaq 100 gaining 2.46% to finish at 24,817.95 points, both indices far from the weekly highs they had achieved in Wednesday’s session. In Europe, gains were more moderate, with the Euro Stoxx 50 rising 1.39% compared to 0.86% for the Ibex 35, closing at 5,608.25 and 15,609 points, respectively.

The impact of geopolitics and doubts in some market niches helped more cautious money flowing out of equities to end up invested in fixed-income assets, and as a result we saw significant declines in debt yields. The 10-year Treasury ended the week at 4.01%, 3 bps above the yield a week ago, but fell to 3.93% at one point. In Europe, yields fell by 5 bps on the Bund and 8 bps on the Bono, closing the week at 2.58% and 3.11% respectively.

Alternative markets seem to have a well-defined trend for now. Gold rose again significantly, specifically 6.65%, ending the week at USD 4,266.60/oz, acting as a safe haven asset, although still far from the new all-time high of USD 4,391.69/oz. This was because, in Friday’s session, and in response to reassuring news from the US financial system, there was a significant sell-off of precious metals. For example, platinum fell 8% at the close from the session’s highs. Brent crude fell again, dropping 2.15% to close at $61.38/bbl, although the USD appreciated slightly, ending the week at 1.1650 after reaching 1.1550 in the middle of the week.

On the macroeconomic front, we continue to lack relevant data. The government shutdown in the United States continues to affect the compilation of economic activity data. We highlight that China published several significant indicators, including export and import data that surprised significantly on the upside, especially import data, which rose 7.4% compared to the expected 1.5%. In addition, inflation remains in negative territory at -0.3%, as do industrial prices, which stood at -2.3%. In Europe, investor confidence as measured by the ZEW institute fell unexpectedly (+22.7 vs. 30.2 expected) and core inflation stood at 2.4%, one tenth above forecasts, while the CPI remained at the estimated 2.2%.

For the current week, the highlight will once again be China. We will see GDP data, the industrial production index, and the unemployment rate. In Europe and the United States, preliminary PMI data for October will be released.

Quote:

We leave you with the following quote from Theophrastus Phillippus Aureolus Bombastus von Hohenheim, known as Paracelsus, a 16th-century Swiss alchemist, physician, and astrologer: “Let us never suppose ourselves to be alone or weak, for behind us are mighty armies that we cannot even conceive of in our dreams.”

Summary of the performance of the main financial assets (10/20/2025)