Financial Markets 04/11/2025

The beacon of the markets:

The last week of October brought no surprises, with central banks sticking to the expected script and only positive news emerging from the meeting between Trump and Xi Jingpin. Corporate results remain positive, creating a favourable environment for the positive trend in financial markets to continue. We are therefore entering the last two months of the year with equity markets very close to their highs and supported by macroeconomics, microeconomics and politics, the latter being the factor that concerns us most given the speed at which opinions change and decisions are made on all strategic fronts.

Once again this week, we have seen new record highs in the indices that we follow most closely in this weekly report. We would also like to highlight that the Ibex 35 has finally managed to surpass its previous record, set in November 2007. The S&P 500 closed with a gain of 0.71% at 6,840.24 points, while the Nasdaq 100 rose 1.97% to end the month at 25,858.13 points. It should be noted that the Magnificent Seven companies, with the exception of Nvidia and Tesla, presented their third-quarter results, which gave the stock markets an additional boost. In Europe, optimism was not as high, with the Euro Stoxx 50 falling 0.23% in the last week of the month to close at 5,661.25 points, 2% below its new high. The Ibex, boosted by this record, rose 1.08% to close at 16,033.70 points.

In fixed income markets, variations in bond yields were minimal. The Bund, the German benchmark with a 10-year maturity, rose 1 bp to 2.63%, while the Bono fell 2 bps to 3.14%. In the United States, there was a change in outlook regarding the Fed’s next move, as the latest macroeconomic data has lowered forecasts for a further 25 bp rate cut in December from a probability of over 95% to less than 65%, after Powell suggested that the decision for the December meeting has not yet been made.

We saw significant corrections in the commodity markets, with gold falling 3% for the second consecutive week, closing October at USD 4,013.30/ounce. Some ‘technical’ sales accompanied by profit-taking after the vertical rise in recent months may have been executed in a less belligerent political environment. In the medium term, we believe that purchases by central banks such as China’s will support gold, but the removal of a tax incentive by the Chinese authorities could cause the current correction to continue, as Chinese citizens have been among the biggest buyers of gold in recent months. Brent crude fell 1.91% to close at USD 64.68/bbl. In this case, the latest studies on the balance between supply and demand in the crude oil market would show an excess of supply and therefore justify the fall in price, which is why OPEC+ decided last weekend to halt its production increase programme. In any case, commodities have been under pressure from the strengthening of the USD, which stood at 1.1535 against the euro.

On the macroeconomic front, the Fed lowered interest rates by 25 basis points, leaving the reference range between 3.75% and 4%. The ECB kept the deposit facility rate at 2%, a level at which we could see it remain for many more months, with no clear indication of the direction of the next move. It should also be noted that there were no surprises with the PMIs in China, that GDP in Europe stood at 1.3%, better than estimated but below the previous 1.5%, and that the CPI fell by one tenth to 2.1%, while the core CPI remained at 2.4%. In the United States, the Atlanta Fed’s GDP estimate for Q3 2025 remains at 3.9%, the Chicago PMI rose more than three points to 43.8, and The Conference Board’s consumer confidence index slightly exceeded forecasts, standing at 94.6.

This week, we will be watching China’s import and export data, PMIs and retail sales data in Europe, and in the United States we will see the PMIs for October, data on inflation expectations and consumer confidence from the University of Michigan, but we will be paying particular attention to the employment data published by the JOLTS (job openings) and ADP (employment demand) surveys. The earnings season continues, with 315 S&P 500 companies having already reported earnings per share (EPS) growth of 15.7%, contrasting with the 8.5% expected by the market before the start of the earnings season. To date, 83% of companies have surprised on the upside, compared with 13% that have disappointed.

Quote of the day: We leave you with the following quote from James Cash Penney, an American businessman and entrepreneur who founded JC Penney stores in 1902: «Five fingers spread apart are five independent units. Close them together and the fist multiplies the strength. This is organisation.

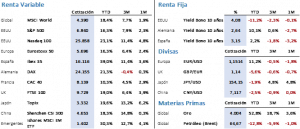

Summary of the performance of major financial assets (3/11/2025)

This report does not provide personalized financial advice. It has been prepared independently of the specific financial circumstances and objectives of the individuals who receive it.

This document has been prepared by Portocolom Agencia de Valores S.A. for the purpose of providing general information as of the date of issuance of the report and is subject to change without prior notice. Portocolom Agencia de Valores S.A. assumes no obligation to communicate such changes or to update the content of this document. Neither this document nor its content constitutes an offer, invitation, or solicitation to purchase or subscribe to securities or other instruments, or to make or cancel investments, nor may it serve as the basis for any contract, commitment, or decision of any kind.

The information included in this report has been obtained from public sources considered reliable, and although reasonable care has been taken to ensure that the information included in this document is neither uncertain nor ambiguous at the time of publication, we do not represent that it is accurate or complete and it should not be relied upon as such. Portocolom Agencia de Valores S.A. assumes no responsibility for any direct or indirect loss that may result from the use of the information provided in this report. Past performance of variables may not be a good indicator of their future outcomes.