Financial Markets 02/12/2025

In recent days there has been a sharp change in the outlook regarding what the Fed’s next move will be. If 10 days ago the market’s view, expressed through interest rate curves, supported an interest rate cut with a 30% probability, now it does so with more than 85%, and this has been the main reason why markets have rallied strongly in recent days to once again stand at the doorstep of all-time highs, especially for the S&P 500, which is eyeing the 7,000-point mark.

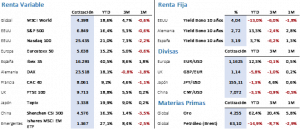

Stock market gains were significant and widespread. The technology sector and small and medium-sized companies were especially favored, as they tend to benefit the most when interest rates fall. In the United States, the S&P 500 recovered 3.73% for the week, closing at 6,849.09 points, while the Nasdaq 100, as a benchmark for the technology sector, posted a 4.93% increase, ending at 25,434.89 points, nearly 1,200 points above the previous week. In Europe, index gains were also important, with the Euro Stoxx 500 rising 2.86% and the Ibex 35 advancing 3.47%, closing respectively at 5,673.13 and 16,371.60 points.

The logical response to the new expectations regarding the Fed’s next decision triggered a correction in government bond yields, which, as expected, were larger in the shorter segments of the U.S. yield curve. Even taking this into account, the ten-year Treasury fell 4 basis points for the week and ended trading with a yield of 4.02%. In Europe, the Bono experienced exactly the same movement, and those 4 basis points left the yield on Spanish ten-year debt at 3.17%, while the German Bund corrected by a single basis point and ended at 2.69%.

In the commodities market, the solidity of price trends was evident. Gold once again recorded a significant rise, this time of 4.34%, to close at 4,256.40 USD/oz, supported by the movement in USD interest rates. In any case, there are two aspects to take into account in the short term: one is that a potential ceasefire in Ukraine could trigger an important correction as defensive positions are unwound, and on the contrary, the general view is that in the medium and long term, gold will continue gaining weight in portfolios, both for central banks and traditional asset managers. For its part, Brent barely fell 0.38% to close at 62.32 USD/b; the end of the war in Ukraine could cause a sharp drop due to the current excess supply, which is the main reason prices are not recovering.

Regarding macroeconomics, in the United States data for September continue to come out, but their impact is barely relevant. From the most recent data, once again we saw declines in the Conference Board consumer confidence survey, meaning the U.S. citizen continues to think that 2026 will be clearly negative, but at the same time, real-economy data continue showing economic strength, such as the 4Q25 GDP estimate from the Atlanta Fed (+3.9%) or weekly jobless claims, which fell to 216,000 when expectations were 226,000. In Europe, the only noteworthy item was the minutes from the latest ECB meeting, which suggest the end of the monetary policy adjustment process may have been reached. But with such gradual growth, dissenting voices emerged pointing to additional corrections to make the European economy grow at a faster pace, though in any case without fear regarding inflation developments. Within the ECB, they will continue depending on the evolution of the main macroeconomic indicators.

This week we will see some recovery in macro activity, so we will be watching the PMI data in China, Europe, and the United States. In addition, in Europe we will learn the evolution of retail sales, CPI, and the unemployment rate. For its part, the United States will publish the monthly JOLTS and ADP data, the industrial production index, and the PCE, the latter corresponding to September.

The quote:

And we say goodbye with the following quote from Theodor Seuss Geisel, American writer and cartoonist, known for his children’s books written under his pen name Dr. Seuss: “You’ll never be bored if you try something new. There really is no limit to what you can do.”

Summary of the performance of main financial assets (12/01/2025)