Financial Markets 23/12/2025

We are entering the final stretch of a very volatile 2025, in which geopolitics has been the main driver, but which is set to end with very attractive returns in both fixed income and equities. Central banks have delivered what the market expected, corporate earnings have continued to grow very solidly, and the latest macroeconomic data have supported investors. With fewer than ten sessions left before the year-end close, the main stock indices are very close to their annual highs, which in most cases are all-time highs. The Ibex 35 set a new all-time high again last week, while the S&P 500 is just 1.25% away from its own, the Nasdaq 100 is 3.30% away, despite the sharp corrections seen in some of the largest stocks in the index, and in Europe the Euro Stoxx 50 is trading just over 1% below its record high.

The stock market week went from less to more, as managers analyzed on the one hand all the information provided by the FED and, on the other, awaited the decisions of other central banks such as the ECB, the Bank of England, or the Bank of Japan, all of which followed the expected script. In addition, the US macroeconomic backdrop has continued to show mixed data, but supportive enough to maintain an adequate level of confidence, while also facilitating a more accommodative monetary policy. The CPI figure surprised notably by falling to 2.7% from the previous 3%. It is true that the data could have been affected by the government shutdown that lasted several days throughout November, but it is nevertheless a figure that facilitates future interventions by the FED. On the negative side, the unemployment rate rose by two tenths to 4.6%, although job creation came in above expectations. The key to this increase in the unemployment rate lies in the rise in labor force participation, a circumstance that usually occurs when those who are unemployed believe there are greater opportunities to find work and register with employment offices. Finally, in terms of economic activity, PMIs did not meet expectations and fell compared to the previous month’s reading, but as a counterpoint, the Atlanta FED continues to expect US GDP to grow by 3.5% in the fourth quarter of 2025.

Something similar happened in Europe: PMIs came in below expectations, but industrial production in November exceeded estimates by growing 0.8%. For its part, inflation remained at 2.1% versus an estimated increase of one tenth; moreover, investor confidence among eurozone companies rose significantly, improving the outlook for 2026. Not to mention that the ECB once again left interest rates unchanged at 2%, a level at which they could remain throughout next year.

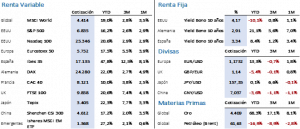

The stock market result of interpreting all this data was a generalized rise in the main indices, especially thanks to buying during the Thursday and Friday sessions. Thus, the S&P 500 closed at 6,834.50 points, implying a slight rise of 0.10%. Meanwhile, the Nasdaq 100 gained 0.60% to 25,346.18 points. In Europe, the Euro Stoxx rose 0.65% to end at 5,758.16 points, and the Ibex 35, after setting a new high, closed at 17,169.80 points, representing an improvement of 1.87%.

In the bond market, we saw uneven behavior between Europe and the United States. While in the Old Continent yields rose again—4 bps on the Bund and 2 bps on the Bono—ending the week at 2.90% and 3.33% respectively, in the United States the 10-year Treasury yield fell by 5 bps. The explanation for this divergence lies in the fact that in Europe, for now, the prospects of further interest rate cuts have receded, as the ECB improved its macro forecasts, whereas the latest CPI data give the FED new room to cut rates if it deems it appropriate.

As for alternative markets, precious metals seem to have no limits in what is shaping up to be an extraordinary year for the sector. Gold once again set a new all-time high during the week and closed at 4,387.30 USD/oz, representing a +1.36% gain. In contrast, oil continues to show weakness: Brent crude fell 1.06% to close at 60.47 USD/b, although it traded below 59 USD/b at one point, very close to annual lows, price levels not seen since early 2021.

The current week, affected by holidays, will bring few macroeconomic references, with nothing relevant in China or Europe. The most noteworthy releases will be in the United States: i) the Q3 2025 GDP figure (preliminary), ii) The Conference Board consumer confidence index, and iii) the most relevant data point of all, the PCE corresponding to the month of October.

The quote:

And we bid you farewell until next year, wishing you all the best for this 2026, which at Portocolom we sincerely hope will be a little kinder and calmer than the year we are leaving behind.

In that sense, what better quote than this one from Pope John Paul II to close the year: “There is no true peace unless it is accompanied by equity, truth, justice, and solidarity.”

Summary of the performance of the main financial assets (22/12/2025)