Financial Markets 10/02/2026

The start of February in the financial markets has been especially volatile. Commodities, and particularly precious metals, have continued to experience very intense reactions following the collapse suffered the previous week, which originated in the ban by Chinese authorities on trading a sector fund that was trading well above the price of the minerals and was considered to be causing distortions in the industrial sectors that demand silver. The initial selling triggered profit-taking orders that have led silver to lose almost 50% from the high reached on January 29.

Another factor that has had a significant impact is the appointment of Kevin Warsh as the next president of the FED. We can find comments both for and against, but for now what seems clear is that the independence of the FED is not expected to be called into question.

The technology sector has experienced its second difficult week. Despite the good results being reported by companies in the sector, market consensus does not seem clear on whether the very large investments committed to AI development will generate returns in line with them. As a result, software companies suffered widespread selling, which was reflected in the Nasdaq, making it one of the indices with the largest correction.

Finally, we must highlight the weak employment results in the United States. The ADP survey showed job creation well below forecasts, while unfilled job vacancies also fell sharply. In any case, two clarifications should be made: first, official data on the evolution of the labor market will not be known until next Wednesday (in recent months they have not been very well aligned with private surveys); and second, the difficult winter that North America is experiencing should be taken into account, a situation that will undoubtedly be affecting both labor supply and demand.

In Europe, the ECB followed the expected script (keeping interest rates unchanged) and sent a message of continuity. However, a reading between the lines of the official statement leaves the door open to possible additional rate cuts if core inflation falls clearly below the 2% target, or if the euro continues to strengthen, as this would trigger a spiral of further inflation declines and would also negatively affect the eurozone’s exporting sectors.

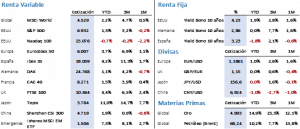

Changes in the main stock market indices were relatively moderate, with the technology sector suffering the largest corrections. The S&P 500 fell 0.10% to close at 6,932.30 points, while the Nasdaq 100 dropped 1.87% to end the week at 25,075.77 points. It is worth highlighting the week’s volatility, with the S&P moving within a price range of more than 3%, while the Nasdaq did so by 5.40%. In Europe, the Euro Stoxx 50 lost 0.37% and closed at 5,925.70 points, but during the week it reached a new all-time high, set at 6,073.34. The Ibex 35 experienced something similar; after setting a new high at 18,271 points, it ended up retreating to close at 17,943.30, or +0.35%.

In fixed income markets, closing prices would indicate stability, but the reality is that weekly price ranges are wide, suggesting a lack of trend in bond yields. Central bank decisions, inflation trends, labor market behavior, and geopolitical risks will continue to set the level of volatility, while the main support for the market will come from corporate earnings, which remain solid and continue to improve expert forecasts.

In alternative markets, volatility also stands out. Gold recovered part of the ground lost the previous week, gaining +4.95% to sit just below 5,000 USD/oz, but silver continues to digest the very heavy sell orders initiated ten days ago, losing 2.08% over the week to close at 76.90 USD/oz. Meanwhile, Brent crude fell 3.58% to close at 68.16 USD/b. In the short term, Iran will continue to be the key catalyst, where military action cannot be ruled out at this time.

Earnings season continues. As of last Friday, 293 S&P 500 companies have reported, with average EPS growth of 14.4% (8.8% expected at the start of the earnings season). Positive surprises amount to 77%, while companies that have disappointed account for 18% of the total.

The quote:

And we say goodbye with the following quote from Jodi Lynn Picoult, American author, winner of the “New England Booksellers Award” for fiction in 2003: “You can always edit a bad page, but you can’t edit a blank page.”

Summary of the performance of major financial assets (9/2/2026)