Rebuilding Trust: Reflections on the World Economic Forum in Davos

The theme «Rebuilding trust» leading the annual World Economic Forum meeting in Davos takes on unprecedented relevance when considering events since 2020. It not only becomes necessary but imperative to work together to restore trust and define the essential principles, policies, and partnerships needed to address the challenges posed by the year 2024.

While there have been critics pointing out the elitist and supposedly less useful nature of this event held in one of Europe’s most spectacular ski resorts, a detailed analysis of the milestones and events related to this gathering of leaders from various fields and geographies reveals highly significant and positive lines of thought and actions. In its early days, Professor and Economist Klaus Schwab, along with his wife Hilde, proposed the theory of «stakeholders,» suggesting that a company should serve all involved parties, not just its shareholders. In 1971, he founded the Forum in Davos, establishing «conscious capitalism» as its guiding principle.

Throughout its 50-year history, the Forum has addressed significant global events, from the fall of the Berlin Wall to economic globalization and climate change. It has facilitated agreements between nations, addressed geopolitical and economic crises, and provided a platform for world leaders, entrepreneurs, activists, and academics.

Let’s review some of the highlights:

- In 1971, the first meeting in Davos brought together European leaders and academics.

- In 1973, the book «The Limits to Growth» was discussed, questioning the sustainability of global economic growth.

- In 1976, a program of business cooperation between the Arab and Western worlds was launched.

- In 1979, the relationship between the Forum and China was established, marking the beginning of annual summits and meetings.

- In 1987, advocacy for rapprochement between the West and the Soviet Union marked the end of the Cold War.

- In 1990, the German reunification was addressed, and European integration was promoted.

- In 1992, the joint presence of South African leaders symbolized the end of apartheid.

- In 1998, the G20 emerged in response to the financial crisis in Asia.

- In 1999, the United Nations Global Compact for corporate social responsibility was established.

- In 2000, the Global Alliance for Vaccines was launched, with the participation of Bill Clinton in the Forum.

- In 2016, the idea of the Fourth Industrial Revolution was proposed, and the Center for the Fourth Industrial Revolution Network was founded.

- In 2019, emphasis was placed on the climate emergency, highlighting the participation of young activists like Greta Thunberg.

- In 2020, on its 50th anniversary, the Forum promoted «stakeholder capitalism» as a response to economic and environmental challenges.

The milestones and historical events associated with the Forum demonstrate its ability to adapt to the world’s changes and challenges, serving as a space for reflection and action in the face of global complexities. Despite criticisms, the World Economic Forum in Davos has maintained its commitment to global cooperation and the push for inclusive dialogue, emphasizing the importance of working together to build a more sustainable and resilient future.

Market Highlights:

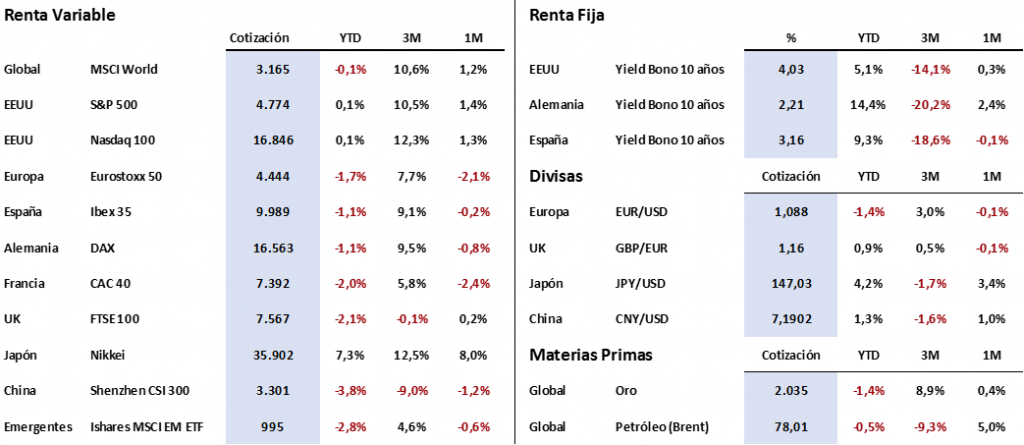

After a start to the year marked by profit-taking in equity markets, the week has seen a recovery for all stock exchanges. In fact, US stock indices, specifically the S&P 500 and Nasdaq, have once again approached the historic highs with which they closed the previous year, recovering what they lost in the early sessions of the year. Europe, on the other hand, has recovered somewhat more timidly, and the Eurostoxx 50 still maintains a slightly negative revaluation at the beginning of 2024.

In fixed income, bond yields have moved in the opposite direction. After several days of recovery, they have turned around with the 10-year US Treasury trading again below 4%. Short-term bonds have further accentuated their declines; in fact, the 2-year US Note fell to 4.13%, a level not seen since mid-May 2023. In Europe, however, bonds have remained stable in recent sessions, almost mirroring the same levels as a week ago (German 10-year bond at 2.20% and Spanish 10-year bond at 3.15%).

On the macro side, last week the US CPI data for December was published. Overall, the data surprised by rising one-tenth more than expected, going from 3.1% to 3.4%, while the core data decreased from 4.0% to 3.9%, though it should be noted that a greater decline was expected. This uptick in general inflation, along with the good employment data that continues to remain at historic lows (unemployment rate in December remaining at 3.7%), could suggest a possible delay in the Fed’s rate cut until the second quarter of 2024 (remember that the market discounts that it will start lowering rates in the first quarter).

In Europe, on the other hand, the inflation data for December confirmed the idea that the last stretch to bring inflation below 2% is becoming complicated. Thus, at a general level, inflation rose to 2.9% from the previous 2.4%, while at the core level, it did manage to decrease by two-tenths to 3.4%.

Quote of the Week:

And we say goodbye with the following quote from Dr. Schwab: «In the new world, it is not the big fish that eats the small fish, it is the fast fish that eats the slow.»

Market Performance Overview 16/01/2024:

The present report does not provide personalized financial advice. It has been prepared independently of the circumstances and financial objectives of the individuals receiving it. This document has been prepared by Portocolom Agencia de Valores S.A. with the purpose of providing general information as of the report’s issuance date and is subject to change without prior notice. Portocolom Agencia de Valores S.A. does not undertake any commitment to communicate such changes or update the content of this document. Neither this document nor its content constitutes an offer, invitation, or solicitation to buy or subscribe to securities or other instruments, or to carry out or cancel investments, nor can it serve as the basis for any contract, commitment, or decision of any kind. The information included in this report has been obtained from public sources and is considered reliable. Although reasonable care has been taken to ensure that the information in this document is not uncertain or unequivocal at the time of its publication, we do not assert that it is accurate and complete, and it should not be relied upon as if it were. Portocolom Agencia de Valores S.A. assumes no responsibility for any direct or indirect loss that may result from the use of the information provided in this report. Past performance is not indicative of future results.