Spanish pharmaceutical company Grifols becomes the latest victim of Gotham City Research

On January 8th, with major markets closed, the U.S. financial analysis company Gotham City Research announced via the social network X (formerly Twitter) that the next day they would release an analysis report on a Spanish company that was excessively indebted, suggesting its shares could be valued at zero. It was soon revealed that the company in question was the Catalan pharmaceutical Grifols. The Gotham City Research report accused the Spanish company of manipulating its debt and earnings before interest, taxes, depreciation, and amortization (EBITDA). Following the publication, the company’s stock plummeted, with the decline exceeding 40% since then.

Grifols quickly denied the report’s allegations, and currently, the CNMV (National Securities Market Commission) is evaluating the information requested from the Spanish pharmaceutical company to analyze the accusations made by the U.S. firm. In this situation, one might wonder, what is Gotham City Research, and who is behind the firm?

It is a financial analysis and research firm created in 2012 by the U.S. citizen of Korean descent, Daniel Yu. According to its founder, they aim to fight fraud and catch corporate fraudsters, drawing inspiration from the superhero Batman. Hence, the firm’s name is the city where the comic character resides: Gotham City. Since its inception, Gotham City Research has issued twelve reports (excluding Grifols) on publicly traded companies worldwide, with accusations revealing irregularities in corporate or accounting practices in only two cases. Therefore, whenever the firm publishes a new report, it tends to attract significant attention, not just from financial analysts.

One of the most well-known cases was precisely involving a Spanish company: Gowex. It was involved in installing WiFi networks in cities worldwide, including important ones like New York City. Everything seemed to indicate that it would become a successful Spanish company, but in July 2014, Gotham published a report proving that the company’s revenues were inflated. Gowex founder Jenaro García initially tried to deny the accusations, but eventually admitted to the fraud and publicly apologized for what happened.

While we have discussed the merits of Gotham City Research, it is worth noting that, according to them, while they claim to fight against fraud and provide information to authorities about alleged corporate criminals, the U.S. firm profits through another channel. Their modus operandi is usually the same: they take a short position in the company before publishing its name and the accusatory report. In other words, they invest through financial tools or products that benefit if the company’s stock price falls. In the case of Grifols, considering the drop in the stock on January 9th after the report’s publication, it is estimated that the U.S. firm gained at least 10 million euros from the short positions (closed on the same day) it had in the Spanish company.

Setting aside ethical and moral considerations, doubts may arise about the legality of publishing information against a company while holding a prior financial position from which one will profit. The way Gotham City Research operates suggests that it is possible, although it could be accused of market manipulation if it were proven that the published information was false. To date, Gotham has not faced legal issues for its actions.

Now we must pay attention to the documentation and information that Grifols provides to the CNMV to confirm whether the accusations were true. Only then can accurate conclusions be drawn.

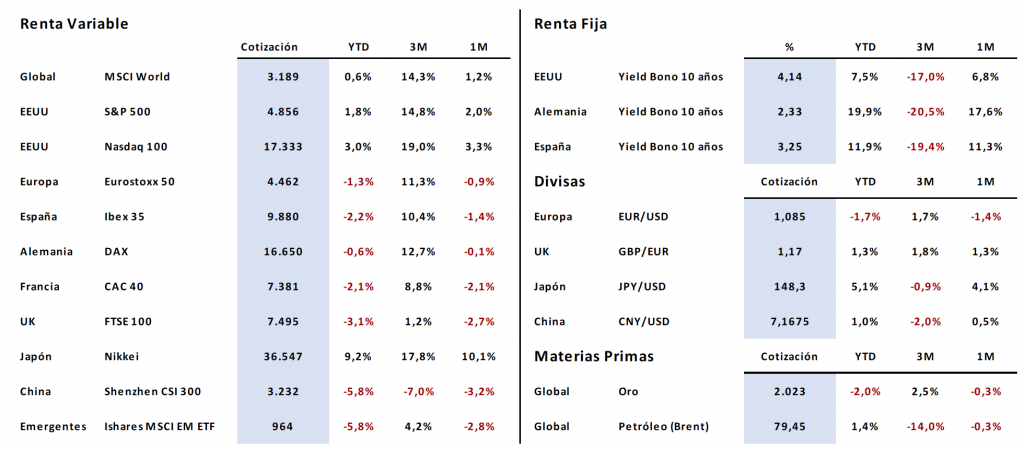

The beacon of the markets:

The week closed marked by the new high achieved by the S&P 500. The good performance on Friday allowed the index to close the week with a 1.15% increase, surpassing the levels seen in the early sessions of 2022. In Europe, the Eurostoxx 50 slightly corrected by 0.70%, while in Asian markets, those related to China experienced weak performance, accumulating nearly 3% declines, affected by the GDP data that stood at +5.2%, slightly below estimates, increasing uncertainty about the health of the economy.

In the fixed-income markets, there were slight increases in yields. The continuous messages from key officials at the Federal Reserve caused short-term movements, but for now, the market continues to bet on significant interest rate cuts throughout the year, which would leave the USD reference rate at 4%. However, the probability of the first cut occurring in the first quarter of 2024 has decreased to less than 50%, compared to 80% the previous week.

In commodity markets, there was a slight correction in gold due to the changing opinions on when (and to what extent) the interest rate cut process will start. Meanwhile, Brent crude remained close to $80 per barrel, but the situation in the Middle East/Red Sea, along with the extreme cold weather in the United States, is causing increases at the beginning of this week.

It is noteworthy that, at the start of the earnings season for the fourth quarter of 2023, they were 85% above expectations, a positive figure. However, with two caveats: only 11% of S&P companies have reported so far, and earnings per share, although better than estimates, reflect the significant declines anticipated by the market.

Regarding macro references, this week we will be watching the European Central Bank meeting on Thursday, where no changes in monetary policy are expected. PMIs for both the Eurozone and the U.S. will be released. In the latter, we will also receive crucial data such as the GDP for the fourth quarter of 2023, the PCE (consumer price deflator), and durable goods orders.

The quote:

We conclude with the following quote from Danish philosopher and theologian Soren Kierkegaard: «Patience is necessary, and one cannot reap immediately where one has sown.»

Weekly note:

Summary of the performance of major financial assets (1/23/2024)

This report does not provide personalized financial advice. It has been prepared independently of the particular circumstances and financial objectives of the individuals who receive it.

This document has been prepared by Portocolom Agencia de Valores S.A. to provide general information as of the report’s issuance date and is subject to change without notice. Portocolom Agencia de Valores S.A. assumes no obligation to communicate such changes or to update the content of this document. Neither this document nor its content constitutes an offer, invitation, or solicitation to buy or subscribe to securities or other instruments or to make or cancel investments, nor can it serve as the basis for any contract, commitment, or decision of any kind.

The information included in this report has been obtained from public sources considered reliable, and although reasonable care has been taken to ensure that the information in this document is neither uncertain nor unequivocal at the time of its publication, we do not assert that it is accurate and complete, and it should not be relied upon as if it were. Portocolom Agencia de Valores S.A. assumes no responsibility for any direct or indirect loss that may result from the use of the information provided in this report. Past performance of variables may not be a good indicator of their future results.