The Chinese economy continues to slow down at a time when its demographic growth has reached a turning point.

The Week:

After the conquest and destruction of Carthage by Roman forces in 146 B.C., marking the end of the Third Punic War (149-146 B.C.) between the powers of the time in the Mediterranean, Rome and Carthage, Scipio Aemilianus, who led the Roman forces in the destruction of the city, reflected on the fate of his own city, Rome, as he witnessed Carthage being razed. According to some historical accounts, it is said that he wept and expressed his fear that someday Rome might face a similar fate. Polybius, a friend of Scipio, asked him, «Why do you weep if victory is yours?» to which the Roman replied, «Because someday this will happen to Rome.» More than five centuries later, in the year 410 A.D., the Visigoths, led by Alaric, with an army of 30,000 men, managed to enter Rome after a long siege. The city was sacked for three days. This event fulfilled Scipio’s prophecy. It underscores that no power is immune to decline and collapse, and the greatness of a civilization can be fleeting.

Much has been written about China’s rise as a global power and whether it will be able to surpass the United States in the top position. Today, thanks to the largest and fastest industrial revolution in history, China is already a superpower. In truth, China and India together accounted for over 50% of the world’s GDP in 3,800 of the last 4,000 years. What we have experienced since the industrial revolution is an anomaly, and many argue that we will return to the old normal. Projections about the future expansion of any economy based solely on the past are not applicable. However, it is crucial to recognize that, in the medium term, an economy can only grow in two ways: through a constant increase in working hours and through productivity gains.

As for the Chinese population, it follows a trajectory similar to that of Japan, but this trend is accelerated by the one-child policy, which was in effect until 2015. A few weeks ago, it was announced that the Chinese population decreased by 2.08 million, according to official data. Although this figure may seem insignificant compared to China’s total population of 1.409 billion, these declines mark the beginning of a long-term downward trend, with population drops of between 0.5% and 1% annually over the next decades. Even these figures could be conservative. A quick calculation indicates that in just three generations, the population will nearly halve if the fertility rate does not increase. Or, if substantial immigration is allowed, which China does not currently permit. China has a surprisingly low number of foreign-born residents; only 0.1% of its residents are immigrants, a percentage that contrasts with 17% in Spain or 16% in the United States.

The second key factor for medium-term growth is productivity, which allows us to do more with less. However, it should be noted that when productivity reaches certain limits, it can no longer grow significantly. This is the situation in China, which has an over-invested and inefficient economy.

Until last year, sustained economic growth allowed China to close the gap with the United States in terms of Gross Domestic Product (GDP). However, this convergence between the two largest economies in the world has slowed. In 2021, China’s GDP represented 76% of the US GDP; today, this proportion has dropped to 67%. It is estimated that the gap between the US and Chinese GDP will exceed 8 trillion dollars in 2023, which is 2 trillion more than in 2022, according to some forecasts.

In the coming decades, we will see if Scipio Aemilianus’s prophecy comes true and if China’s rise materializes—a change that has never happened peacefully before.

Market Highlights:

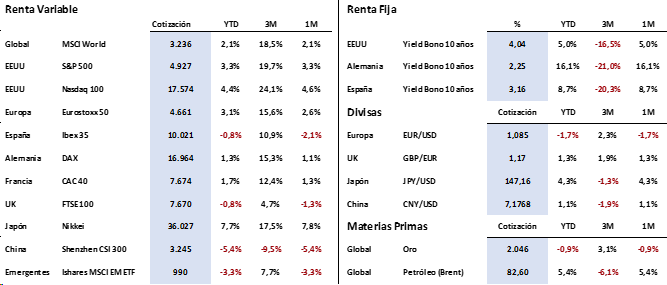

The stock markets closed the past week with widespread gains in major indices. The S&P 500 rose by 1%, marking several new historical highs. In Europe, the Euro Stoxx50 regained ground against American markets, rising more than 4%. Poor PMI (Purchasing Managers’ Index, an economic indicator providing insight into business conditions) data in Germany and France have fueled the idea that the ECB could anticipate, before the expected date of April 25, the start of adjustments in monetary policy. In China, doubts about the economy’s ability to react persist. On Monday, it was revealed that a court ordered the liquidation of Evergrande, a company that was suspended from trading with a market value of 275 million euros, compared to the over 50,000 million it once valued.

In the bond markets, yields remained within a narrow range, with the 10-year US bond fluctuating between 4.10% and 4.20%. The key to the next move is in the hands of central banks; when and how much they will cut interest rates is crucial for the future movements of all financial asset classes. In any case, there has been a correction in bond yields; new estimates refer to a reduced need to increase the deficit in the United States, leading the 10-year bond yield close to 4%. Similar declines were seen in European sovereign debt.

Among the data from last week that cooled investor sentiment, the US GDP stood out, surprising with a rise of 3.3% against an estimated 2%, demonstrating the strength of the US economy. This, in turn, dispels the possibility of a recession in the short term and, therefore, an imminent interest rate cut. This week, the main macroeconomic reference will be the FED meeting, especially the subsequent speech where investors will be closely watching for signals from the FED to anticipate the start of rate cuts. On the other hand, on Friday, the unemployment rate in the United States will be revealed, a data point that will provide important information about the real strength of the economy. Additionally, on Tuesday, the private employment survey (JOLTs) will be released, indicating where Friday’s data might stand. In Europe, the most notable event will be on Thursday when the Eurozone inflation data is released, and Christine Lagarde will once again testify, with the market eagerly anticipating the expected rate cut.

Let’s not forget that we are in the midst of the earnings reporting season, and it is noteworthy that before the end of Friday, we will have the results of Alphabet, Microsoft, Qualcomm, Apple, Amazon, and Meta Platforms—five of the seven giants that led the stock market in 2023. Among commodities, the rise in crude oil prices is noteworthy, driven by the situation in the Red Sea and the extreme cold in the United States, leading to very low refined product production in January. Brent surpasses $82 per barrel after reaching highs above $84, a situation that does not help to definitively control inflation.

The Quote:

And we bid farewell with the following quote from Nobel Prize-winning economist Joseph Stiglitz: «The financial sector has perfected its skills to take money from people without contributing to social progress.»

Summary of the performance of major financial assets (1/30/2024)

The present report does not provide personalized financial advice. It has been prepared independently of the circumstances and financial objectives of the individuals receiving it. This document has been prepared by Portocolom Agencia de Valores S.A. with the purpose of providing general information as of the report’s issuance date and is subject to change without prior notice. Portocolom Agencia de Valores S.A. does not undertake any commitment to communicate such changes or update the content of this document. Neither this document nor its content constitutes an offer, invitation, or solicitation to buy or subscribe to securities or other instruments, or to carry out or cancel investments, nor can it serve as the basis for any contract, commitment, or decision of any kind. The information included in this report has been obtained from public sources and is considered reliable. Although reasonable care has been taken to ensure that the information in this document is not uncertain or unequivocal at the time of its publication, we do not assert that it is accurate and complete, and it should not be relied upon as if it were. Portocolom Agencia de Valores S.A. assumes no responsibility for any direct or indirect loss that may result from the use of the information provided in this report. Past performance is not indicative of future results.