The Resurgence of Nuclear Energy: Lessons from the Past

In 2011, Italy held a national referendum on the construction of new nuclear power plants. The vote took place shortly after the Fukushima disaster, and the result was a resounding vote of distrust: 94% voted against. This led to the closure of existing nuclear plants and a ban on the creation of new facilities nationwide. After significant incidents such as Three Mile Island, Chernobyl, and Fukushima, the negative reputation of nuclear energy lingered in our collective consciousness for a long time. However, upon closer examination, the reality is that all these incidents had easily identifiable causes, ranging from absurdly complex control centers to poorly controlled safety tests and avoidable engineering oversights. In response to Fukushima, safety standards were significantly strengthened, making the subsequent years possibly the safest in the history of nuclear energy.

By 2022, memories of nuclear disasters had faded. However, it was the war between Russia and Ukraine and the subsequent reassessment of the European Union’s energy policy that truly changed the landscape. European governments, faced with a mismatch between foreign policy and dependence on Russian gas, began seeking alternatives that could provide energy independence. While renewable energies like solar and wind offered a partial solution to energy independence, the unique ability of nuclear energy to provide constant «base load» power makes it stand out among low-carbon energy sources (there is no solar energy at night when the sun is not shining).

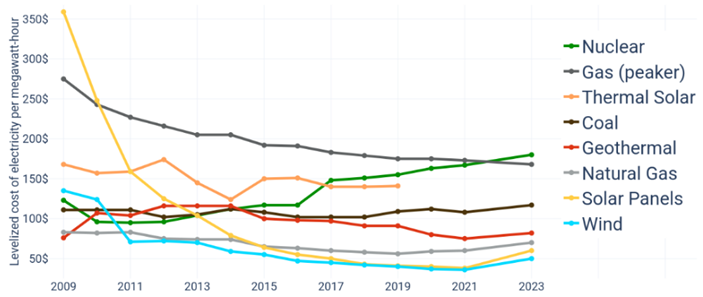

The second factor that propelled renewed interest in nuclear energy was inflation. France, with around 70% of its electricity coming from nuclear sources (compared to 20% in Spain or 12% in Germany), experienced lower inflation than its EU counterparts heavily reliant on gas. This is because nuclear power plants, despite their high initial construction costs, can generate very cheap energy once operational, contributing to cost stability and helping curb inflation. In contrast, gas power plants require constant purchase of imported gas, contributing to price increases and inflation.

In 2022, the European Parliament voted to classify nuclear energy as a «sustainable» energy source. Subsequently, at COP28 in 2024, 22 countries committed to tripling their nuclear capacity by 2050. These two changes marked significant support for nuclear energy as a key player in the global transition to sustainable and reliable energy sources.

However, despite the significant advantages of nuclear energy, high construction costs hinder its potential as a miraculous solution. Unlike mature nuclear plants, new large nuclear facilities have experienced an increase in expenses over the past decade. This is because the aftermath of the Fukushima disaster simultaneously led to increased regulation and a decrease in nuclear investments, resulting in a reduction of skilled labor and a decline in specialized sector knowledge. The subsequent delays in nuclear plant construction significantly contributed to cost increases.

Source: Lazard

With the rising costs of nuclear energy and new projects that could take a decade to build, it is too early to declare victory for this energy source. But it does seem to be on the cusp of a revival. In addition to increased investment in traditional mega-nuclear plants, a new wave of startups is offering a fresh perspective on traditional nuclear energy in the form of «Small Modular Reactors» (SMRs). These are essentially much smaller versions of the giant plants we are accustomed to, providing greater flexibility, scalability, and transportability. This reduced complexity from an engineering perspective could, in turn, help reduce construction delays. Perhaps SMRs are the perfect solution the world needs right now.

Market Highlights:

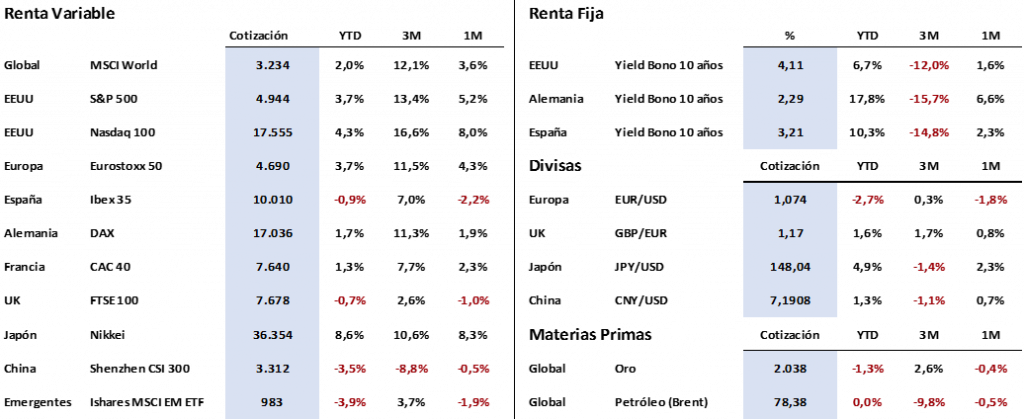

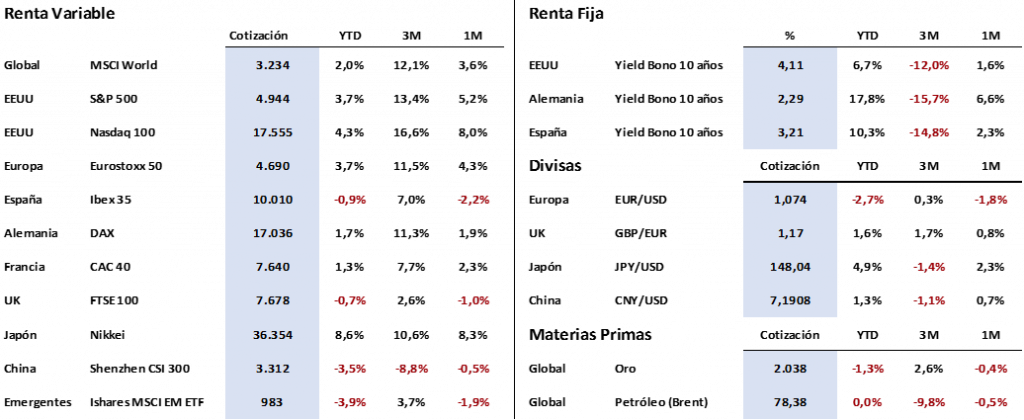

After a strong start to the stock market year, we experienced a week of relative calm with very limited volatilities. For example, the Eurostoxx 50 remained within a range of 1.25% between the high and low, ending with a weekly gain of 0.40%, very similar to the 0.31% gain in the S&P 500. Results for major tech companies were very positive for Meta, which announced its first dividend and rose more than 15%, and Amazon, which climbed over 9% with strong sales figures. Google, on the other hand, fared the worst with initial declines of 6% after presenting results that disappointed analysts.

We faced significant macroeconomic references that, even with mixed results compared to market expectations, left the impression that the economy’s strength pushes away the possibility of a recession in the short term. Diverse data were published, including employment, ISM (survey among large companies on economic activity in the services sector), PMIs (indicator of economic activity level), consumer confidence, and European CPI. But above all, the expected decision by the Fed to maintain interest rates in the United States and make it clear that there will be no rate cut in March had a direct consequence on the markets. This led to a strong upward reaction in US bond yields, dragging with the same intensity those of other developed countries and bringing the yield on 10-year debt back above 4% (4.15% at present), which had approached 3.80%. The USD also was affected, appreciating against major traded currencies. On the contrary, Brent’s price corrected sharply (-6.15%) due to several factors: firstly, the appreciation of the USD; secondly, despite the uncertainty in the Red Sea, the discounted negative impact is diminishing; and thirdly, signals of economic activity in China remain very weak, lowering global demand forecasts for this asset.

Investors’ main concern is focused on the health of US regional banks, the culprits of the 2023 crisis that left a hole of over 500 billion dollars. Doubts are negatively affecting, in a widespread manner, smaller capitalization values, which are already losing ground in just one month compared to large indices. It is noteworthy that the benchmark index for these banks closed its worst week since May. For the current week, there are no major macroeconomic references that could direct the markets, but central bank officials will appear, and the market will closely watch their comments to try to anticipate the moment when the first interest rate cut occurs. This will be the clearest signal that inflation is under control. Therefore, investors’ attention will focus on analyzing the results published by companies, which, according to Bloomberg’s estimates, will be slightly above expectations.

The Quote:

And we bid farewell with the following quote from American scientist Guy R. McPherson: «If you really believe that the environment is less important than the economy, try holding your breath while counting your money.»

Summary of major financial asset performance (6/2/2024)

This report does not provide personalized financial advice. It has been prepared independently of the circumstances and specific financial objectives of the individuals receiving it. This document has been prepared by Portocolom Agencia de Valores S.A. to provide general information as of the report’s issuance date and is subject to change without prior notice. Portocolom Agencia de Valores S.A. does not commit to communicate such changes or update the content of this document. Neither this document nor its content constitute an offer, invitation, or request to buy or subscribe to securities or other instruments or to carry out or cancel investments, nor can they serve as the basis for any contract, commitment, or decision of any kind.

The information included in this report has been obtained from public sources considered reliable, and although reasonable care has been taken to ensure that the information included in this document is neither uncertain nor unequivocal at the time of its publication, we do not state that it is accurate and complete, and it should not be relied upon as if it were.