Inflation in the United States falls less than expected in January, delaying expectations of a rate cut by the Fed.

The Week:

Inflation data continues to be a clear focus in the evolution of financial markets. In its latest report, the OECD presented a 2024 inflation forecast ranging from 2% to 3% for most major global economies, specifically 2.3% for the United States and 2.6% for the Eurozone. However, recent data from Germany (January CPI at 2.9% vs. 3.7% in December), the United States (December PCE at 2.6%), and China (0.8% in January) suggest that these countries are already close to the levels predicted by the OECD.

Nevertheless, the US CPI data published yesterday has raised doubts about these forecasts. General inflation has fallen, but less than expected, as the consensus among analysts anticipated a significant drop from 3.4% to 2.9%, but it ended up at 3.1%. As for core inflation, a two-tenths drop was expected, but it ultimately remained at 3.9%. These data strengthen the idea of a possible delay in the Fed’s rate cut until at least June, when, until relatively recently, there was speculation about an initial rate cut in March. In his recent statements, Powell once again mentioned «data dependence» regarding growth and inflation, emphasizing that the Federal Reserve neither wants to rush rate cuts until inflation is definitively under control nor can afford to do so too late, as the US economy could be negatively impacted.

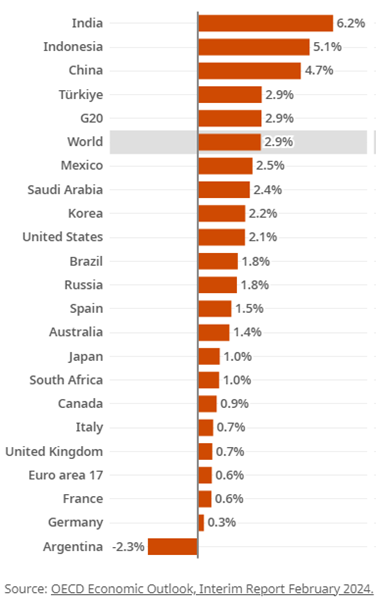

The OECD has also revised upward its global economic growth forecasts, projecting a 2.9% growth for 2024. This represents only a slight slowdown compared to the 3.1% growth in 2023. In terms of regions, the Eurozone stands out with projected growth of only 0.6%, with countries like France and Germany continuing to show clear economic deceleration. This is evident in the latest data on both manufacturing PMI (remaining in contraction territory at 46.6) and the GDP for the last quarter (-0.1%), resulting in a 2023 annual growth of +0.5%. In emerging markets, India is expected to surpass China as the country with the highest growth in 2024 (above 6%), a country that increasingly plays a more significant role in global production chains and industrial and technological development.

Meanwhile, the United States continues to present positive macroeconomic data (ISM at 53.4 vs. 50.5 the previous month), with a robust labor market (353,000 non-farm payrolls created in January, well above the expected 185,000 and December’s 333,000).

Despite the negative reaction to the US inflation data, the market is currently pricing in a much more optimistic scenario than we had last year. We have shifted from assuming a «Hard landing» due to the steep rise in rates between 2022 and 2023 to discussing a soft landing or even growth for 2024, in a context where unemployment levels remain close to historic lows, and job creation is picking up pace. Additionally, inflation seems fairly controlled below 4%, and although recent data raises some uncertainty with the risk of possible upticks in this final stretch before reaching 2%, the reality is that we are far from the double-digit levels seen at the end of 2022.

GLOBAL GDP GROWTH PROJECTIONS FOR 2024 (OECD)

Given this outlook, the market has lowered its expectations of a Fed rate cut, both in terms of timing (no longer assigning probabilities to the first cuts in March, but rather pushing them to June) and in depth, as cuts of around 120 basis points are now expected, well below the 175 points projected at the end of 2023.

However, several risks persist, such as economic stagnation in Europe, uncertainty in China, especially related to the real estate sector, US elections, and the situation of the global mid-sized banking sector associated with real estate. The banking sector has recently made headlines again due to potential issues with regional entities like New York Community Bancorp, whose rating Moody’s has downgraded to Ba2 (High Yield). This bank, which had acquired part of the troubled Signature Bank, has set aside provisions for insolvencies amounting to $552 million, well above the $45 million expected by analysts, reminding the market of the risks associated with such real estate-related credits.

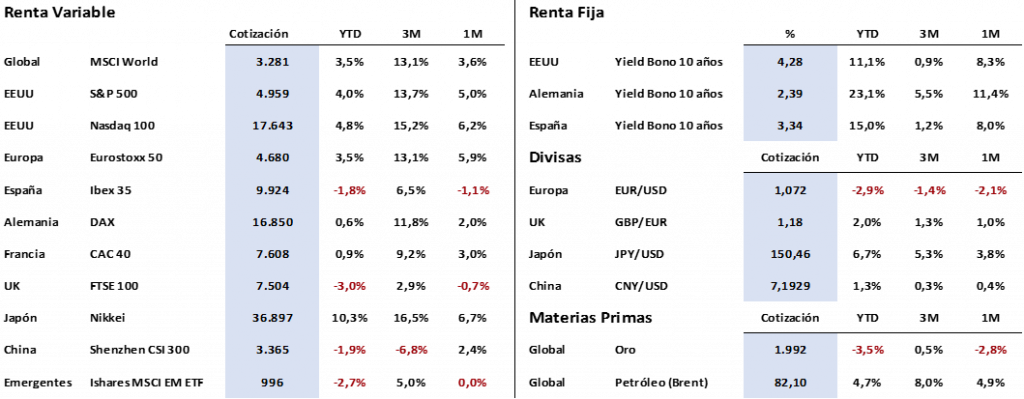

Spotlight on markets

Last week, the markets continued to please investors, with the S&P 500 surpassing 5,000 points for the first time and setting historic highs in days marked by the absence of relevant macroeconomic references. However, these trends may change, as seen yesterday when US inflation data was higher than expected, prompting bond purchases and equity sales. We will see what happens on Thursday when retail sales are released and on Friday with producer price data.

The yield on 10-year German bonds has experienced a significant increase so far this month, reaching 2.40% compared to 2.13% on the first day. The same has happened with US bonds, which now generate a 4.28% return compared to 3.86% at the beginning of February. Recent statements from Fed and ECB members suggest that the first central bank rate cut will occur later than initially expected, thanks to the strong performance of the US economy.

The earnings season for the fourth quarter of 2023 is ongoing, with a very high average score for US companies (more than 70% have reported earnings per share well above estimates). However, the European results are not as bright, with companies barely surpassing estimates that are clearly lower than the previous year. Caution is advised given the high levels reached by the stock market, and is there an opportunity to position oneself in medium and long-term fixed income? We believe this could be the right strategy given the current macroeconomic environment.

The Quote:

And we conclude with the following quote from Mother Teresa of Calcutta: «I do what you cannot do, and you do what I cannot do. Together we can do great things.»

Summary of the performance of major financial assets (2/13/2024)

This report does not provide personalized financial advice. It has been prepared independently of the specific circumstances and financial objectives of the individuals receiving it.

This document has been prepared by Portocolom Agencia de Valores S.A. to provide general information as of the report’s issuance date and is subject to change without notice. Portocolom Agencia de Valores S.A. does not undertake to communicate such changes or update the content of this document. Neither this document nor its content constitutes an offer, invitation, or solicitation to buy or subscribe to securities or other instruments or to make or cancel investments, nor can it serve as a basis for any contract, commitment, or decision of any kind.

The information included in this report has been obtained from public sources considered reliable, and although reasonable care has been taken to ensure that the information in this document is neither uncertain nor unequivocal at the time of publication, we do not assert that it is accurate and complete, and it should not be relied upon as such. Portocolom Agencia de Valores S.A. assumes no responsibility for any direct or indirect loss that may result from the use of the information provided in this report. Past performance of variables may not be a good indicator of future results.