Copper: Current Dependency and Future Challenges

Topic of the week:

Copper has played a significant role in the development of society in recent centuries and is a key element to meet the growing demands of renewable energy and technology. Electrical conduction, electronic applications, communication infrastructures, and transportation systems are just a few areas where copper has become irreplaceable.

Chile is the largest exporter of copper, and its deposits have allowed it to maintain a significant position in the international market; it is expected that Chile will reach a copper production of 6.43 million tons in 2034, growing at an average annual rate of 1.7%. Copper mining represents a significant part of the Chilean economy, and its ability to maintain high production levels has solidified its position as the largest exporter of the red metal. However, Chile needs to increasingly extract more land to obtain the same amount, which means it has to spend a lot to maintain the same export levels, posing a long-term concern.

The major importers are China, the U.S., and Germany. China is not only a major producer but also the world’s leading importer. Domestic demand for infrastructure, electronics, and electric vehicles has driven its need to import large quantities. China’s influence on the copper market is undeniable, and its position as the top importer continues to strengthen.

The United States is a key player in copper consumption, and its demand has experienced a significant increase in recent years due to reindustrialization. The expansion of infrastructure, the push for electronic manufacturing, and the transition to cleaner energy sources have contributed to this phenomenon. The electrification of transportation, in particular, has generated significant copper demand in the United States. The manufacturing of electric vehicles and associated infrastructure, such as charging stations, requires substantial amounts of copper. Additionally, the modernization of electrical grids and the promotion of energy efficiency have driven the need for this metal in the country.

Germany, with its strong industrial base, is another important importer. The transition to more sustainable technologies, the demand for electric vehicles, and the manufacturing of machinery and electronic products have contributed to the increase in imports. Globally, modern society has witnessed a very large increase in copper consumption, and there are significant challenges. Demand for electric transportation, for example, has grown as more countries seek to reduce their dependence on fossil fuels. The expansion of charging infrastructure for electric vehicles and the development of more efficient batteries are responsible for increased consumption. Looking ahead, projections indicate a continuous increase in copper demand: a Goldman Sachs study in 2021 predicts that by 2030, copper demand will be 600% larger.

Technology, with its constant advancements, will continue to require more copper to fuel innovation. However, these projections face the challenge of balancing growing demand with limited resource availability. Copper-rich deposits are dwindling, and the exploration of new deposits faces economic and environmental challenges. Lack of access to sufficient amounts of copper could hinder the implementation of key technologies.

Society is in a dilemma where technological innovation, environmental sustainability, and efficient resource management must converge. The search for alternatives, improvement in copper usage efficiency, and investment in recycling technologies are essential elements to mitigate the risks associated with potential scarcity in the future and ensure that copper continues to be a facilitator of human progress. It is also possible that new copper mines may be discovered, mainly in Africa, and change the global landscape of available supply, but currently, as far as we know, the world’s capacity to produce or recycle may not meet the growing demand in the coming decades.

Market Spotlight:

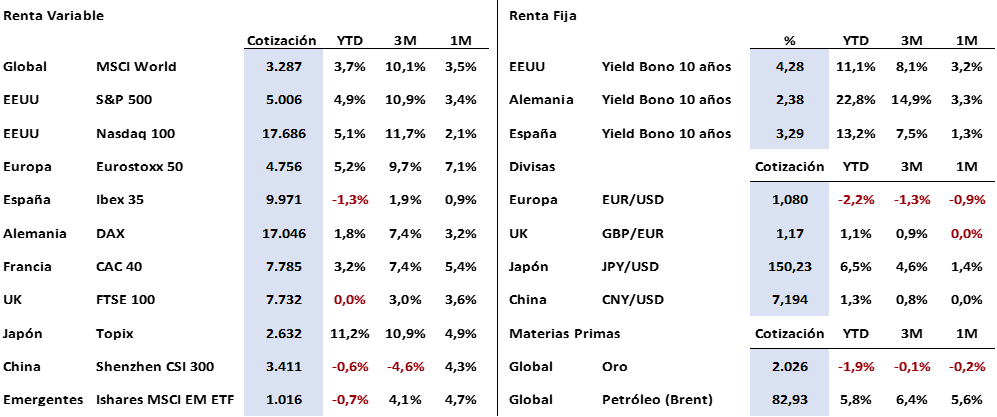

The strength of the S&P 500 was interrupted last week with a minimal drop of -0.42%. The benchmark index had managed to rise in 14 of the last 15 weeks since the rally began in late October 2022, a circumstance that had not occurred since 1972. Meanwhile, the Nasdaq 100 surpassed the 18,000-point mark for the first time, and the Japanese Nikkei 225 approached just 1% below its historical highs from 1989. In Europe, the Euro Stoxx 50 ended with gains of over 1% in sessions with strong volatility, and the Chinese market did not participate due to the New Year holiday.

The trigger for the events in the financial markets was the inflation data released on February 13 in the United States, which clearly exceeded analysts’ expectations (+3.1% vs. +2.9%) and caused significant movements in asset prices initially. The components that most contributed to the price increase were transportation and housing, sectors of great importance in the economy.

However, seven days after the publication, the impact on the stock markets has been minimal, while bond markets have seen an increase in yields. The 10-year U.S. bond closed the week with a yield of +4.28% compared to the previous +4.17%.

On the macroeconomic level, other important data were known in the world’s leading economy, which can be considered mixed (retail sales lower than expected or producer prices above), but for now, they do not anticipate an economic downturn, quite the opposite. The United States continues to have a very strong labor market, and economic activity seems to be revitalizing, as indicated by the manufacturing activity data (ISM) led by new orders (increased business activity).

In the current week, we will learn about the CPI data in the Eurozone and the PMI (measuring private sector activity and predicting its movements in the coming months) data for manufacturing and services in the U.S. (both on Thursday). But the most notable will be revealed this afternoon when the minutes of the last Fed meeting are published, where the market expects to obtain additional information on when the first rate cut could occur. In this regard, the yield curve is discounting that this will happen in June, and no more than four cuts would take place in 2024.

As for commodities, there is an increase in volatility and widespread corrections in precious metals that reacted to the increase in interest rates. Regarding oil, its ascent continues, as the situation in the Red Sea does not improve. Although the latest consumption forecasts by international organizations are not very positive due to the economic dynamics in China, Brent remains above $83 per barrel but fails to surpass the $85 highs of the last three months. On the contrary, natural gas, the Henry Hub reference, continues to fall and is at levels not seen in recent years.

Finally, today we will learn about the results of Nvidia, the technological giant that has revolutionized AI and was the trigger for the sharp rises in U.S. indices in 2023 led by the group of the Magnificent 7. It is an important publication since the market considers that we could be facing a bubble in the sector, and data that disappoint (or do not excite the market) could lead to profit-taking with consequences that are difficult to predict.

The Quote:

And we bid farewell with the following quote from Charlie Munger, who was Warren Buffet’s right-hand man at Berkshire Hathaway: «My system in life is to understand what is really stupid and avoid it. It doesn’t make me popular, but it saves me a lot of trouble.»

Summary of the performance of major financial assets (20/2/2024)

This report does not provide personalized financial advice. It has been prepared independently of the circumstances and specific financial objectives of the individuals receiving it. This document has been prepared by Portocolom Agencia de Valores S.A. to provide general information as of the report’s issuance date and is subject to change without prior notice. Portocolom Agencia de Valores S.A. assumes no commitment to communicate such changes or to update the content of this document. Neither this document nor its content constitutes an offer, invitation, or solicitation to buy or subscribe to securities or other instruments or to carry out or cancel investments, nor can it serve as the basis for any contract, commitment, or decision of any kind.

The information included in this report has been obtained from public sources considered reliable, and although reasonable care has been taken to ensure that the information in this document is neither uncertain nor unequivocal at the time of its publication, we do not assert that it is accurate and complete, and it should not be relied upon as such. Portocolom Agencia de Valores S.A. assumes no responsibility for any direct or indirect loss that may result from the use of the information provided in this report. Behaviors of variables in the past may not be a good indicator of their future outcomes.