Multiple Fund Managers Exit Climate Action 100+ Initiative

This Week’s topic:

Several investment firms have recently decided to leave Climate Action 100+. This is an alliance of asset management companies that aims to engage the companies that produce the most greenhouse gases to reduce such emissions and implement climate transition plans.

Climate Action 100+ was created in 2017 and has more than 700 investors representing around $68 trillion in assets under management. However, in recent weeks, JPMorgan, State Street Global Advisors, and Pimco have decided to leave the initiative. BlackRock also announced that it would transfer its stake in the parent company to BlackRock International, which is more focused on Europe and offering sustainability-focused solutions. These four asset managers alone account for approximately $14 trillion in assets under management, which represented approximately 20% of the total managed by Climate Action 100+.

Other asset managers have also left the initiative, such as Vanguard in 2022. The organization has responded by announcing that around 60 new investors have joined the initiative since June 2023, despite the recent departures.

All these companies argue that their departure does not mean that they are abandoning their fight against climate change. They simply disagree with the guidelines set by the initiative, arguing that they are not consistent with their policies of autonomy and independence in decision-making. They also claim that the interests of their clients will be better defended through their own initiatives.

One of the main reasons for their departure is that Climate Action 100+ is going to intensify its efforts and implement a new phase in June. This will involve moving from an activity focused on raising awareness and disclosing climate risks to a phase of implementation and climate transition in the main CO2-emitting companies. Other asset managers have gone further and have stated that the organization has gone too far in implementing this second phase, and that the initiative conflicts with US laws that require managers to seek long-term economic benefit and prioritize financial results.

In addition, there has been some politicization of these movements, especially by some US Republican politicians and anti-ESG advocates. They argue that these initiatives go against key traditional sectors for the US economy, such as oil companies, and have even tried to criminalize some of them.

We are seeing how many asset managers are retreating not only from these types of initiatives, but also from regulations and products related to sustainability and ESG. Many of us intuited what could happen with the SFDR regulation and the classification of funds and ETFs into products without sustainability objectives (Article 6), which promoted social or environmental initiatives together with traditional performance objectives (Article 8) or which had a clear sustainability objective (Article 9). And so it was, both in 2022 and 2023 with a flurry of investment products being reclassified from Article 9 to Article 8.

Another example is the change that several products have made in relation to their benchmark index. In Europe, two of the main ESG indices are the European Climate Transition Benchmark (EU CTB) and the European Carbon Aligned Benchmark (EU PAB). They are often used interchangeably, with the former being significantly less strict than the latter in terms of exclusions of companies with high emissions and overall decarbonization targets. The underlying assets of the first transition index comply with the minimum standards set by the European Union to be considered companies on the path to decarbonization, while the companies in the second index comply with the minimum alignment standards set by the European Union in the Paris Agreement. We have analyzed that the correlation between both indices is over 90% and their performance has been similar, but that neither of them is aligned with the Sustainable Development Goals (SDGs).

In conclusion, after an initial overreaction where almost everyone wanted to jump on the ESG investment bandwagon, we are seeing how many are now backtracking after making commitments that in many cases were unrealistic. Therefore, we are experiencing a situation in which many asset managers are returning to a neutral position which, to a certain extent, is even appropriate for both the industry itself and the final investor in the mission of improving transparency in the market and genuinely channeling investment flows to social and environmental investments.

Markets in the spotlight

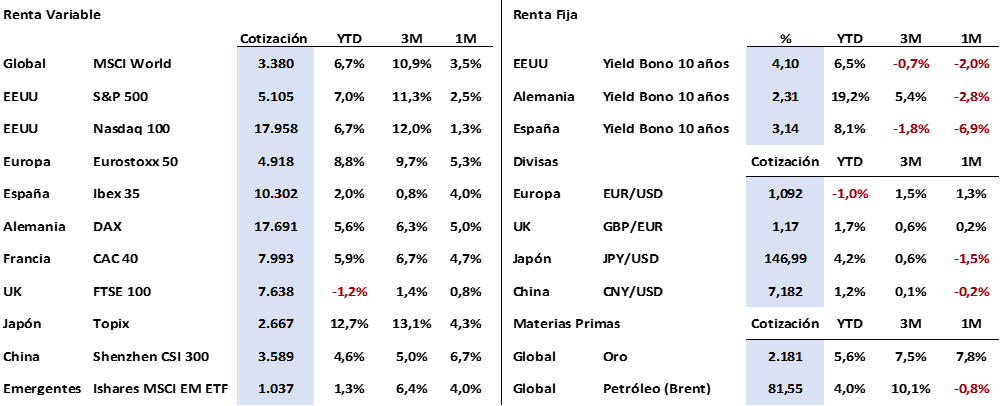

After the close of markets last Friday, we highlight the mixed performance of US stock markets versus European markets. Gains were widespread in the Old Continent, where the Ibex 35 rose 2.40% and the Euro Stoxx 50 rose 1.35%. For its part, the S&P 500 closed in negative territory in the last bars of the session, finally closing with a fall of -0.26%, while the Nasdaq 100 fell by -2.76%. Envidia fell by 5.6% in the last session of the week, at the same time as it experienced a significant increase in volatility.

Regarding fixed income markets, the trend was generally towards lower yields in the major developed markets. Government bonds saw their yields decrease. The benchmark 10-year bonds fell by 9 basis points in the US, 14 basis points in Germany, and 24 basis points in Spain.

The reason for the different behavior of stocks and bonds can be seen in the final stretch of the Friday session. The good health of the US labor market was confirmed, with 275,000 jobs created compared to the 198,000 estimated by the market. However, there were also positive references for the macro economy: the unemployment rate increased from 3.7% to 3.9%, and the wage increase was one tenth below expectations.

The other important reference last week was the appearances of the main monetary policy makers. From the FED, Jerome Powell, in his appearance before Congress, transmitted a reassuring message about the evolution of inflation, which caused the start of the decline in yields on US debt, as well as the USD, which fell to the 1.0950 zone. For her part, Christine Lagarde of the ECB, after lowering the estimates of both economic growth and inflation for the euro zone for 2024 and 2025, hinted at a more favorable scenario for interest rate cuts, which the market is currently discounting for June, in line with what the FED will do.

Today we will see the US CPI data for February, the most important macroeconomic reference of the week at the macro level. The market is discounting a flat figure of 3.1%, while core inflation is expected to correct by two tenths to 3.7%. If these forecasts are confirmed, we could see further declines in bond yields. The PPI data will be published on Thursday, which should confirm the CPI estimate. The other focus of attention for investors will be the US retail sales data, which will also be released on Thursday. A certain recovery is expected, with growth of +0.8% month-on-month from a fall of -0.8% in January.

It is also worth noting the very good performance of the gold price, driven by the prospects of lower interest rates. During the week, it managed to break through the $2,075/oz barrier and set a new all-time high of $2,195/oz last Friday.

Oil, on the other hand, fell by 1.75% during the week. It is currently unable to overcome the $84/b resistance, which is a good sign for bringing down global inflation to 2%, the level desired by central banks to end the inflationary period that began in 2021. In this regard, we will be very attentive to what the reports presented this week by OPEC+ and the IEA say about world crude demand estimates, in a complex context due to the situation in the Red Sea, the economic uncertainty in China, and the war conflicts in Ukraine and Gaza.

The Phrase:

And we close with the following quote from Mikhail Gorbachev, a Russian politician: «When future generations judge those who came before them on environmental issues, they may come to the conclusion that they did not know. Let us avoid going down in history as the generations who knew, but didn’t care.»

Summary of Main Financial Assets’ Performance (11/3/2024)

This report does not provide personalized financial advice. It is prepared independently of individual circumstances and financial objectives. It is subject to change without prior notice. Neither the document nor its content constitutes an offer, invitation, or solicitation for the purchase or subscription of securities or other instruments or for the execution or cancellation of investments.

This document has been prepared by Portocolom Agencia de Valores S.A. to provide general information as of the issuance date and is subject to change without prior notice. Portocolom Agencia de Valores S.A. does not commit to communicating such changes or updating the content of this document. Neither this document nor its content constitutes an offer, invitation, or solicitation for the purchase or subscription of securities or other instruments or for the execution or cancellation of investments, nor can it serve as the basis for any contract, commitment, or decision of any kind.

The information included in this report has been obtained from public sources deemed reliable, and reasonable care has been taken to ensure that the information in this document is not uncertain or unequivocal at the time of its publication. Portocolom Agencia de Valores S.A. does not assert that it is accurate and complete, and it should not be relied upon as if it were. Portocolom Agencia de Valores S.A. assumes no responsibility for any direct or indirect loss that may result from the use of the information provided in this report. Past performance of variables may not be a good indicator of their future results.