The evolution of inflation continues to set the tone for Central Banks

19.03.24

Topic of the week:

The overall evolution of inflation globally continues to be the clear protagonist in the markets in recent weeks, mainly due to the influence it may have on decisions regarding interest rates by Central Banks. In general, the latest published data shows how the disinflationary trend has slowed down, and it is becoming increasingly difficult to reach the desired level of 2%. In the Eurozone, the latest CPI data showed that both general inflation, at 2.6%, and core inflation, at 3.1%, decreased less than initially expected (2.5% and 2.9%, respectively). In the United States, the data published last Tuesday followed the same trend at the core level, where a decrease of two tenths to 3.7% was expected, but it only decreased by one to 3.8%. However, overall, it was expected that prices would remain at 3.1%, but they finally rose to 3.2%.

Regarding Central Banks, Jerome Powell appeared before the House of Representatives and the Senate a few days ago and hinted that the FED could start moving before summer, as long as, however, inflation continues to decline steadily and the rise in prices is contained around 2%. At the moment, the market discounts that we may see up to three decreases of 25 basis points each during 2024, with the first one taking place in June. However, in the United States, the economy continues to show signs of strength and coexists with very low levels of unemployment, which makes it difficult for the FED to make decisions, as it is more challenging to argue for a significant and rapid reduction in interest rates. Therefore, the market could be starting to anticipate in its rate cut forecasts, which may come later and be less intense than expected.

In fact, combining the above with the latest inflation data known in March (with general increases), increases the chances of seeing few interest rate cuts throughout 2024. This could also limit the European Central Bank in its monetary policy actions, as if it lowers interest rates too much compared to the FED, it could harm the euro against the dollar.

Precisely, the ECB kept interest rates unchanged at its last meeting, and it has already held them steady four times. However, the change in tone has been clear, and the ECB is anticipating a turning point in its monetary policy before summer. Key points in their speech have been, on the one hand, the downward revision of growth expectations in the eurozone (a GDP growth of +0.6% is expected for 2024, contrasting with the +0.8% they expected in their December forecasts), and on the other hand, the reduction in the forecasted inflation rate for 2024, which they expect to be at 2.3%, when just three months ago they anticipated 2.7%. Undoubtedly, the normalization of energy market prices has influenced this revision. From 2025 onwards, they expect inflation rates of 2% or lower, thus within the central bank’s price increase objectives. Both changes in future forecasts favor the decision to lower interest rates. In fact, Christine Lagarde announced that the first move could come in June, and market expectations indicate that between 3 and 4 cuts of 25 basis points could be made.

In China, the annual economic policy meeting was held where the main strategic lines to be followed were outlined, aiming to support growth and regain investor confidence in the Asian giant. China aims to shift its economic model towards more efficient and productive industries. So far, its economy has been mainly based on exports, infrastructure, and the real estate sector, and now they announce that Artificial Intelligence, the development of electric cars, and semiconductors will take center stage. Regarding the latter, and to combat the strong restrictions on access to this technology imposed by the United States, they have announced the creation of a special fund for the semiconductor industry endowed with 27 billion dollars.

Additionally, a growth target of 5% was set for 2024, and the issuance of 1 trillion yuan (139,000 USD) in special purpose bonds for local governments, with very long maturities, was announced.

Spotlight on markets:

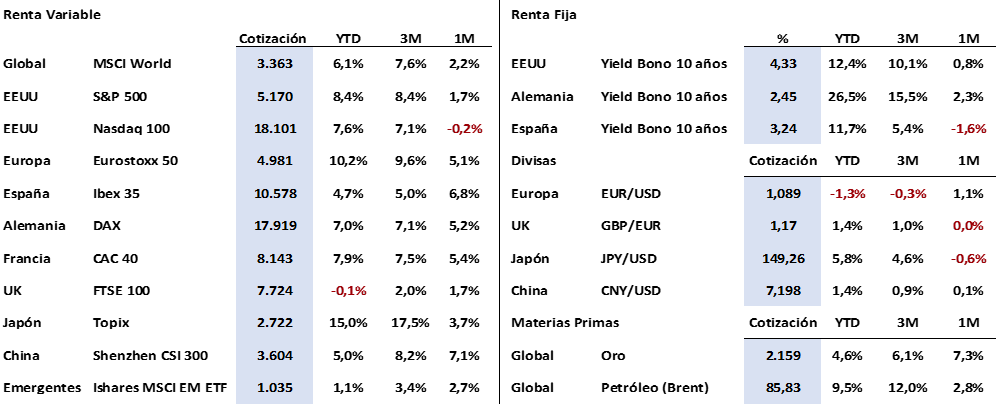

Last week saw an adjustment between the stock markets of the old continent and the United States, which reduced the gap between the returns of both regions so far this year. While the S&P 500 fell by a minimal -0.13%, the Nasdaq 100 corrected by -1.17%, and on the other hand, the Ibex 35 rose by +2.80% and the Euro Stoxx 50 by 0.50%. The stock markets remain with an overall positive tone reflected in the current low levels of volatility, but at the same time, investors are closely monitoring the evolution of macroeconomic data, which has been very changeable in recent weeks.

The fixed income market experienced a very parallel global movement, in which we saw increases in bond yields from the +0.21% of the American 10-year Treasury (+4.30%) or the +0.17% of the German Bund or the Spanish Bond. The market’s main indicator is inflation data, and this is moving global fixed income in unison.

Regarding commodities, there was a slight profit-taking in gold (-1%) after reaching historic highs the previous week, with a very stable EUR/USD exchange rate trading between 1.088 and 1.098 throughout the week. The biggest changes were seen in the price of crude oil, with Brent up 4% for several reasons, among which are i) the IEA report estimating a slight improvement in demand for 2024, leaving current production at insufficient levels, ii) the OPEC+ agreement to maintain current production cuts at 2 million barrels per day until mid-year, and iii) attacks on several Russian petrochemical facilities that could affect the availability of petroleum derivatives globally.

After an intense week in terms of macroeconomic data, the current one will once again feature important references for investors. The monthly FED meeting stands out, in which on Wednesday they will announce that interest rates remain stable, but revisions to the main economic magnitudes will be announced. In the United States, PMI data for manufacturing and services will also be released, with a slight correction expected but remaining in expansion territory. In Europe, the CPI data will be closely monitored to see how it could evolve in the coming months, as it is key information regarding the start of future interest rate cuts by the ECB.

The phrase:

And we bid farewell with the following quote from historian Thomas Fuller: «We never know the worth of water till the well is dry.»

Performance of major financial assets (03/18/2024)

This report does not provide personalized financial advice. It has been prepared independently of the particular financial circumstances and objectives of the individuals receiving it. This document has been prepared by Portocolom Agencia de Valores S.A. for the purpose of providing general information as of the date of issuance of the report and is subject to change without notice. Portocolom Agencia de Valores S.A. does not undertake to communicate such changes or to update the content of this document. Neither this document nor its content constitutes an offer, invitation, or solicitation to buy or subscribe to securities or other instruments or to make or cancel investments, nor can it serve as the basis for any contract, commitment, or decision of any kind. The information included in this report has been obtained from public sources considered reliable, and although reasonable care has been taken to ensure that the information included in this document is not uncertain or ambiguous at the time of its publication, we do not state that it is accurate and complete and should not be relied upon as if it were. Portocolom Agencia de Valores S.A. assumes no responsibility for any direct or indirect loss that may result from the use of the information provided in this report. Past variable behaviors may not be a good indicator of their future outcome.