Investment opportunities in making buildings more energy efficient

09.04.24

The topic of the week:

We are currently in a global context, largely led by Europe, which, in terms of sustainability, is characterized by an ambitious approach to protecting the environment and improving social conditions. That is why the European Union has implemented policies and regulations to address a variety of issues, including improving energy efficiency.

There are different scales at which to frame the issue of improving energy efficiency: the territorial scale, where optimizing resources and sharing renewable energy sources has become a global necessity. The urban scale, where cities play a fundamental role in the tasks pending for the improvement of energy efficiency, being responsible for 70% of global emissions and occupying only 3% of the land surface. And the scale of the building of the aforementioned cities, where buildings generate 1/3 of CO2 emissions and only in Spain, 4 out of 5 buildings (82%) are inefficient from the point of view of energy qualification, so it seems reasonable to require that they comply with the sustainability conditions that are required in the medium term.

Energy efficiency in buildings not only has a positive impact on the environment, but also offers numerous financial advantages. By reducing energy consumption, owners can experience a significant decrease in long-term operating costs, which increases the profitability and value of the real estate asset. Likewise, the implementation of energy efficiency technologies and practices can take advantage of a series of government and financial incentives.

That is why European institutions have set themselves the goal of achieving climate neutrality by 2050. Among many others, we highlight Objective 55, which establishes how the EU will transform climate objectives into legislation. To this end, the objective has been set to reduce greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels. The step taken in the European institutions with the approval of the instruments that will govern the achievement of the purposes of the Objective 55 package of measures, focuses on the importance of addressing the improvement of the energy efficiency of the public and private building stock, setting specific deadlines for the achievement of the objectives that improve the traditional model followed up to now.

Even with the arrival of funds from the Next Generation plan that are being managed by the Autonomous Communities and with the tax incentives that, at the central government level, are proposed to stimulate the action of the owners of the building fabric, it seems clear that the breadth of the action will require the participation of other investors who participate in the process. In addition to regulatory requirements, improving energy efficiency is becoming a basic eligibility criterion for the acquisition of real estate assets, as investors increasingly seek opportunities that promote sustainability and social responsibility.

Until now, the comprehensive rehabilitation of buildings and the improvement of active and passive measures has meant a very important investment need for owners, who recover said investment through the amortization that occurs due to the savings in the energy bill and in the tax burden. This process, if it is to be carried out with due diligence, must seek alternative sources to traditional financing.

The participation of investors in this global process represents a challenge for financial advisory experts, which makes it possible to concentrate efforts on opening the impact investment market towards objectives of greater social commitment.

Spotlight on Markets:

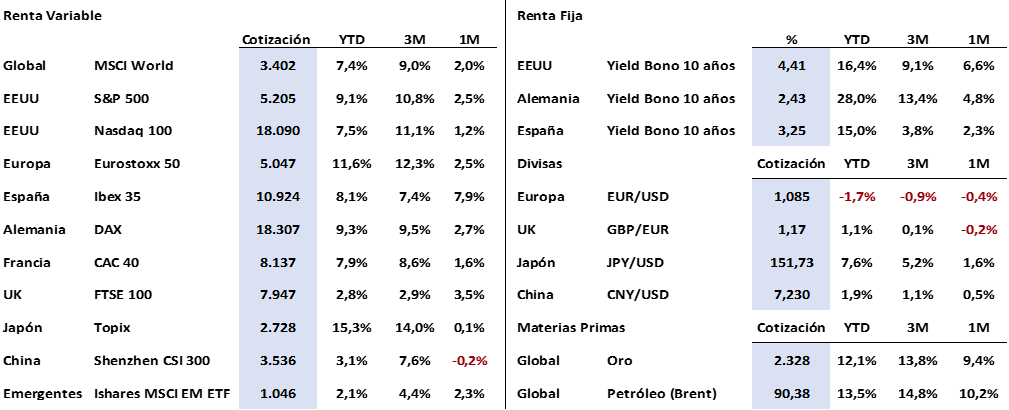

Global equities suffered their first week of moderately significant sales in 2024. The Ibex 35 and the Nasdaq 100 fell 1.45%, the Eurostoxx 50 1.25% and the S&P 500 0.95%. The falls could have been greater, but investors reacted again with purchases after learning about good employment data in the US that confirm, once again, the good health of the US economy.

In the fixed income markets, the opposite movement occurred, that is, the sale of bonds that caused the profitability of these to rise. In this case, the movement was more pronounced in US debt, whose 10-year bond rose 18 bp to 4.38%, marking an annual high of 4.43%, a level not seen since November. In Europe, the rise in yields was somewhat lower, between 9 and 12 bp, the German Bund at 10 years gives a return of 2.40% and the Spanish Bond a 3.24%.

As for raw materials, there were again notable increases, including those of gold and oil. Gold closed on Friday at the gates of the historical high that it marked in that session (2,329 $/oz vs 2,330 $/oz), some central banks would be the ones behind this wave of purchases to reinforce their strategic reserves. As for crude, on Friday Brent closed at 91.2 $/b, slightly below the highs of the week and at levels not seen since October, the growing tension in the Middle East spurs purchases in the face of possible supply interruptions.

The justification for the behavior of the assets lies in the macroeconomic data known throughout the week. In general, they were above estimates, such as the ISM data, the GDP forecast of the Atlanta FED for the first quarter of the year (+ 2.8% vs + 2.3%), the PMIs of Europe and China or the CPI of the euro zone. But what really affected the week was the very good employment data in the US, more than 300,000 new jobs were created when the market estimated 212,000, in addition, that job strength was not affected by wage increases, with the unemployment rate falling to 3.8% (3.9% previously).

Investors are calibrating on the one hand the strength of the economy and therefore, how much longer the current positive cycle could be extended, and at the same time they are analyzing the impact that this economic solidity could have on the decisions of central banks. In fact, the market is already discounting that three 25 bp interest rate cuts will not occur in the US in 2024, since factors such as rising fuel costs, a very complicated geopolitical environment (Iran is gaining ground to enter fully into the war between Israel and Hamas), together with that economic strength, could end up causing a rise in inflation levels and thus truncate, especially, the FED’s forecasts.

This week we will not have important references until tomorrow, Wednesday, when the CPI in the US is released, a figure of + 3.4% is expected compared to the previous 3.2%, on the other hand, core inflation will fall one tenth to stay at 3.7%. On Thursday, the ECB meets, which will not change its monetary policy, but could give clues about when its first move would occur. On the same Thursday, we will see the OPEC monthly report, for which no surprises are expected either, it will maintain its position regarding production cuts until June. Throughout the week we will have numerous appearances by relevant members of the FED and the ECB that will serve to try to predict their future movements, and most importantly of the week, starting on Friday, April 12, the earnings season for the first quarter begins, with Citigroup, Wells Fargo, BlackRock or JP Morgan presenting, among others, which will show the health of the financial system.

We say goodbye with the following quote from the English writer and motivator Simon Sinek: «Genius lies in the idea, but the impact comes from action.»

Asset class performance (8/4/2024)

This report does not provide personalized financial advice. It has been prepared independently of the particular financial circumstances and objectives of the people who receive it.

This document has been prepared by Portocolom Agencia de Valores S.A. for the purpose of providing general information as of the date of issue of the report and is subject to change without notice. Portocolom Agencia de Valores S.A. assumes no obligation to communicate such changes or to update the content of this document. Neither this document nor its content constitutes an offer, invitation or solicitation to purchase or subscribe to securities or other instruments or to make or cancel investments, nor can it serve as the basis for any contract, commitment or decision of any kind.

The information included in this report has been obtained from public sources and considered reliable, and although reasonable care has been taken to ensure that the information included in this document is not inaccurate or misleading at the time of publication, we do not represent that it is accurate and complete and should not be relied upon as such. Portocolom Agencia de Valores S.A. assumes no responsibility for any loss, direct or indirect, that may result from the use of the information provided in this report. Past behavior of variables may not be a good indicator of their future performance.