Artificial Intelligence: Threats and Opportunities

Topic of the Week:

Artificial Intelligence (AI) has rapidly transitioned from being a source of inspiration for science fiction movies to becoming a reality that generates unprecedented interest and anticipation. AI, already present in virtually all aspects of our lives, has the potential to become the most impactful and transformative technological change in history, bringing with it both opportunities and threats.

Among the main opportunities related to AI, we can highlight:

-Advances in the healthcare sector: The expectations in this field are enormous, as AI can enhance medical diagnosis, predict diseases, and personalize treatments, undoubtedly contributing to saving lives. According to a report by the World Health Organization (WHO), AI has evident potential to strengthen the provision of health services to underserved populations, improve public health surveillance, advance health research and drug development, support healthcare system management, and enable clinical professionals to enhance patient care and make complex medical diagnoses.

-Automation and efficiency in the industry: The implementation of AI systems in the industry could optimize processes, reduce errors and costs, and improve efficiency and decision-making, resulting in increased productivity and competitiveness, and freeing up resources to drive innovation and economic growth. A McKinsey study estimates that AI could contribute $4.4 trillion to the global economy, and an IDC study forecasts that global spending on AI solutions will reach $500 billion by 2027.

-Innovation in mobility and transportation: AI is a fundamental part of the development of autonomous vehicles and intelligent transportation systems, promising to improve road safety, reduce traffic congestion, and revolutionize urban mobility. According to a Bloomberg study, the fleet of autonomous vehicles is expected to reach 100 million by 2026.

-Improvements in the financial sector: Although AI did not enter the financial sector with the same force as in other sectors, its implementation is accelerating across all areas, from algorithmic trading to risk management and fraud detection. According to an IDC report, 39% of financial institutions already use or have begun testing some form of AI.

Among the main threats of AI, we highlight:

-Algorithmic bias risk: AI algorithms can bias the data used to train them, potentially accentuating and perpetuating discrimination in areas such as human resources selection or loan approval, increasing existing economic disparities. For example, a Stanford University study revealed that machine learning algorithms used in financial lending could systematically discriminate against certain demographic groups, undermining fairness in access to credit.

-Job displacement: Although it is difficult to predict the real impact, a large number of jobs will be automated and/or performed by some form of AI in the future, requiring a reconfiguration of the labor market and generating significant concerns about potential unemployment levels. According to IMF estimates, 60% of jobs are at risk of automation in advanced countries.

-Loss of privacy: With the exponential growth in the amount of generated and/or collected data (estimated that 90% of stored data has been generated in the last two years) and the AI’s ability to process and analyze it, a major concern revolves around privacy and the misuse of personal information.

-Increase in inequality: If not addressed properly, the transition to Artificial Intelligence could generate and/or exacerbate economic and social inequalities. The IMF estimates that 40% of jobs worldwide will be affected by AI, while in less developed countries, the percentage of affected jobs decreases to 26%. It also predicts an increase in the wages of young workers with higher incomes, while suggesting the possibility that older, lower-income workers may end up unemployed with few opportunities for reemployment.

In conclusion, the future of artificial intelligence is full of opportunities but also threats, further accentuated by the different speeds at which each country is addressing the legal, sociological, economic, ethical, etc., challenges it presents. Therefore, it seems essential to work towards ensuring that this technology has a sustainable impact, benefiting society equitably and responsibly. Many questions arise about the future of Artificial Intelligence, and, like with all revolutions, many prophecies may never come to fruition. The key may lie in how much humans will be able to limit and control the misuse of AI, allowing them to harness its full potential while keeping in mind that the goal should always be to put technology at the service of people and not the other way around.

Market Spotlight:

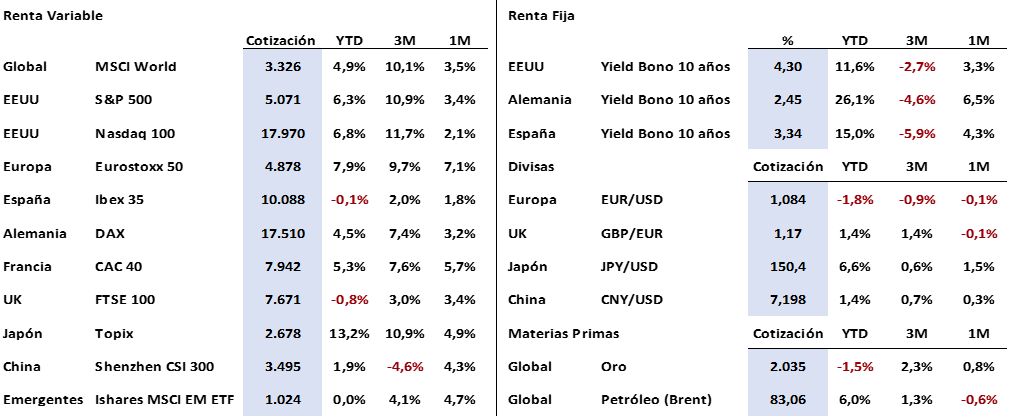

Equity markets rose generally last week, ranging from +1.42% for the Nasdaq 100 to +2.25% for the Euro Stoxx 50, with several historical highs observed. In fixed-income markets, government bond yields corrected between three and five basis points.

Known macroeconomic references reaffirmed the current scenario of economic strength, with mixed data indicating that current interest rate levels are affecting growth and helping «control» inflation. Highlights include i) Eurozone CPI (+2.8%), in line with expectations, ii) U.S. PMIs, better than expected for the manufacturing index but below for the services sector, both in expansion territory, and iii) the U.S. weekly employment data, surprising with its strength.

For the end of February, notable references include U.S. consumer confidence, Eurozone CPI, or China’s PMI, but the market will be closely watching i) the first U.S. GDP data for the fourth quarter of 2023 (to be released this afternoon) and ii) the Fed’s «favorite» inflation measurement, the Personal Consumption Expenditures (PCE) index.

Regarding corporate results, the most notable in the last seven days was the investors’ reaction to Nvidia’s results, clearly above market expectations for both the fourth quarter of 2023 and forecasts for the first quarter of 2024. The stock rose 20% in two sessions, moving from the fifth to the current third position in the ranking of the largest companies.

In these financial markets that have yet to define future movements, investors remain attentive to the data being published to anticipate what will happen in the coming months. Undoubtedly, the timing and extent of the first interest rate cuts by the Fed and the ECB are crucial for the future of the markets. Meanwhile, sentiment remains positive.

The Quote:

And we conclude with the following quote from Norman Vincent Peale, an American writer and creator of the theory of positive thinking, «It’s always too early to quit.»

Summary of the Performance of Major Financial Assets (February 27, 2024)

This report does not provide personalized financial advice. It has been prepared independently of the circumstances and specific financial objectives of the individuals receiving it. This document has been prepared by Portocolom Agencia de Valores S.A. to provide general information as of the report’s issuance date and is subject to change without prior notice. Portocolom Agencia de Valores S.A. assumes no commitment to communicate such changes or to update the content of this document. Neither this document nor its content constitutes an offer, invitation, or solicitation to buy or subscribe to securities or other instruments or to carry out or cancel investments, nor can it serve as the basis for any contract, commitment, or decision of any kind.

The information included in this report has been obtained from public sources considered reliable, and although reasonable care has been taken to ensure that the information in this document is neither uncertain nor unequivocal at the time of its publication, we do not assert that it is accurate and complete, and it should not be relied upon as such. Portocolom Agencia de Valores S.A. assumes no responsibility for any direct or indirect loss that may result from the use of the information provided in this report. Behaviors of variables in the past may not be a good indicator of their future outcomes.