The stages of women’s lifecycle

The topic of the week:

In light of International Women’s Day on March 8th, we want to reflect on the different stages of women’s life cycles and the challenges they face at each one. From childhood to old age, women go through unique experiences that shape their lives and perspectives. Like everything in life, we encounter both encouraging news and areas where there is still progress to be made.

Childhood and adolescence: During childhood, girls develop cognitive and language-related areas. In the world’s poorest countries, it is more challenging to be a girl.

-Over 200 million girls and women have experienced female genital mutilation, a terrible practice that directly violates their rights. The numbers are staggering: over 4.3 million would be at risk of undergoing it in 2023.

-UN Women, the United Nations entity for Gender Equality and Women’s Empowerment, states that compared to three decades ago, girls today are one-third less likely to be mutilated. This progress is attributed to the global program launched in 2008 by the UN Population Fund and UNICEF, focusing on 17 African countries.

-Today’s 1.1 billion girls are ready to face the future. Every day, girls are breaking barriers, addressing issues such as child marriage, inequality in education, violence, and unequal access to healthcare. Girls are proving to be unstoppable (UNICEF).

Adolescence: This stage is characterized by significant physical, emotional, and social changes.

-Emotional development in adolescence involves exploring values and the need for positive support to manage stress. Menstruation during adolescence requires learning about the menstrual cycle, symptoms, care, and managing possible irregularities and delays.

-Teenage pregnancy is a leading cause of mortality among adolescents, and 4 out of 10 teenagers aged 15 to 19 who want to avoid pregnancy do not have access to contraceptive methods (UNICEF).

-Currently, there are over 600 million teenage girls worldwide. With the right resources and opportunities, they will become the largest generation of women leaders, innovators, entrepreneurs, and architects of the greatest change the world has ever seen.

Youth: This stage lasts until the age of 25 and brings physical stability, self-awareness, and self-acceptance.

Young women do not use the internet in low-income countries, while their male counterparts are twice as likely to access the internet.

-Every dollar invested in the health and sexual and reproductive rights of teenagers can generate economic benefits of up to $120, leading to improved health and increased opportunities.

Adulthood and maturity: This stage lasts until the age of 60 and is characterized by emotional stability, personal and professional development.

-Menopause in maturity brings menstrual changes and physical and emotional symptoms, typically occurring around the age of 50.

-Women earn less than men. The gender pay gap in Spain is 28.21%.

-Menopause, which used to be discreet, has gained more visibility in recent years among women and the media, shedding light on one of the most critical moments in a woman’s life cycle.

Old age: From the age of 60 onwards, there are gradual bodily changes and health problems.

-The difference in life expectancy between men and women is smaller when women do not have access to healthcare services.

-Women live longer than men: in the EU in 2019, the life expectancy at birth for women was 84 years, compared to 78.5 for men, a difference of 5.5 years.

In addition to these stages, women’s greater sensitivity compared to men makes them more susceptible to suffering. However, sensitivity has its advantages, helping to live with greater intensity and leaving a lasting impression on the memory of wonderful experiences. Managing this sensitivity and leveraging it as an opportunity is in our hands.

Spotlight on markets:

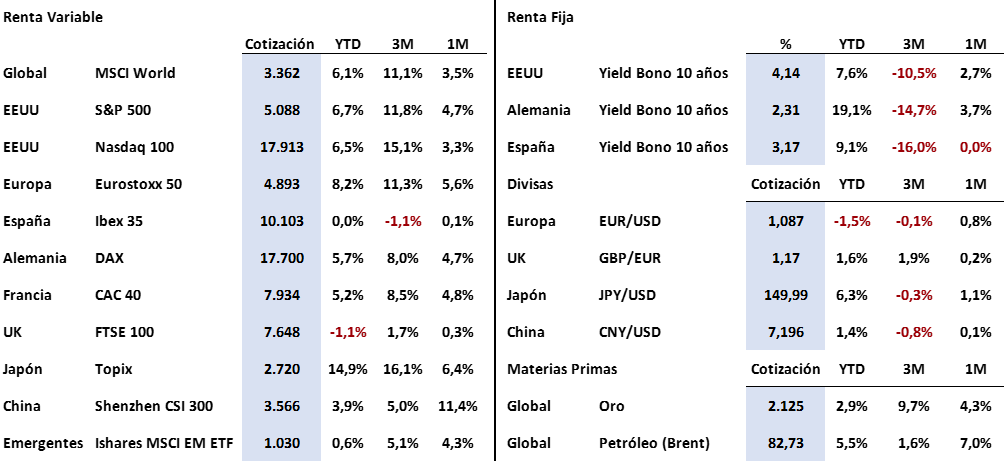

Once again, the published macroeconomic data has fueled the bullish cycle in the major stock markets. The S&P 500 closed the week marking its 15th annual historical high (adjusted for inflation, still 3% below said historical high), and the known PCE data on Thursday, +2.8% and in line with estimates, reassured investors after the strength shown by the CPI and PPI a few days earlier. Thus, the S&P 500 ended with a gain of 1%, the Euro Stoxx 50 rose by 0.50%, while the Ibex 35 fell by 0.65%, heavily penalized by the renewable energy sector, which experienced a sharp decline.

In the bond markets, movements were in line with the new macro references. The 10-year US bond yielded 0.08% to finish the week at 4.18%, the German Bund dropped 5 bps to 2.36%, the same yield decrease as the Spanish bond that ended at 3.25%. Particularly noteworthy was the decline in the shorter end of the curve, with a 2-year US bond falling 16 bps to close the week at 4.53%, after the annual highs seen a few days earlier at 4.75%.

The recent macroeconomic data in the US, such as PCE, GDP (+3.2% vs. +3.3% estimated), or consumer confidence (106 vs. 114 estimated), while good, describe an economic activity showing strength but not exuberance, as it does not exceed analysts’ estimates. This alleviated fears that interest rates might delay the timing of the first cut, which the market currently places in July.

In this regard, Federal Reserve Chairman Jerome Powell’s words before Congress will be closely scrutinized by the investment community, seeking any clues to understand the central bank’s behavior in the coming months. Alongside Powell’s testimony, the information regarding the US labor market will be relevant this week. On Wednesday, we will learn the ADP and Jolts survey data, and on Friday, the non-farm payrolls data is expected to drop to 190,000 jobs created, compared to the 353,000 of the previous month.

In Europe, the main reference will be the ECB meeting scheduled for Thursday. No changes are expected in monetary policy, but we will closely monitor Christine Lagarde’s words since the market is pricing in the first rate cut for April, given the low growth levels estimated for the continent’s two largest powers (recall that both France and Germany lowered their growth forecasts for 2024, the latter settling at a meager +0.2%).

Regarding commodities, we highlight the strength of crude oil, which remains close to $84 per barrel in Europe, while West Texas has surpassed $80. The OPEC+ has decided to maintain production cuts to prevent an oversupply, and the annual congress of the Chinese People’s Party starting today could announce stimulus measures that could significantly improve current estimates for the Asian giant in 2024. Remember that the situation in the Red Sea, far from being resolved, seems to be complicating after the sinking of a merchant ship in the last hours.

We continue to read and hear messages of caution regarding asset valuations, especially large-cap US stocks, but the truth is that, to date, no negative news has emerged from the economic front. However, on the geopolitical front, we cannot be at ease, and these valuations could lead to corrections of some importance in a very short time.

The Quote:

And we conclude with the following quote from Martin Luther King, American pastor, and activist, «If I knew that the world was going to end tomorrow, I would still plant a tree today.»

Summary of the performance of major financial assets (5/3/2024)

This report does not provide personalized financial advice. It has been prepared independently of the specific circumstances and financial objectives of those who receive it.

This document has been prepared by Portocolom Agencia de Valores S.A. to provide general information as of the date of the report and is subject to change without notice. Portocolom Agencia de Valores S.A. assumes no obligation to communicate such changes or to update the content of this document. Neither this document nor its content constitutes an offer, invitation, or request for the purchase or subscription of securities or other instruments or for the execution or cancellation of investments, nor can it serve as a basis for any contract, commitment, or decision of any kind.

The information included in this report has been obtained from public sources considered reliable, and although reasonable care has been taken to ensure that the information in this document is neither uncertain nor unequivocal at the time of its publication, we do not state that it is accurate and complete, and it should not be relied upon as if it were. Portocolom Agencia de Valores S.A. assumes no responsibility for any direct or indirect loss that may result from the use of the information provided in this report. Behaviors of variables in the past may not be a good indicator of their future outcome.