Inflation takes different paths in the United States and Europe

16.04.24

Inflation takes different paths in the United States and Europe, which will most likely mean that the European Central Bank will be the first to lower interest rates.

The divergence between Europe and the United States in terms of inflation is becoming more entrenched. In the euro zone, the preliminary HICP figure for March was 2.4%, one tenth lower than the market forecast and two tenths lower than the February figure. In addition, on this occasion, core inflation is also moving in the same direction, falling to 2.9% from 3.1% previously. It seems clear that inflation in Europe is no longer a problem, and this fact will have a significant impact on future monetary policy decisions by the European Central Bank.

In the United States, the situation is quite different, as there are some variables, such as the strength of the economy and the price of energy, that are preventing inflation from subsiding. The US CPI had already shown an increasing figure in February, both at the general and core levels (3.2% and 3.8% respectively), and the latest data published last week corresponding to the March CPI confirmed that the trend has definitely reversed. The market was expecting a further rise to 3.4% at the general level and a small correction of the core CPI to 3.7%, however, the final figure ended up at 3.5% and 3.8%.

In this context, with price levels moving further away from the 2% target, expectations for interest rate cuts by the Fed are once again being reduced in number and delayed in time. The Federal Reserve kept rates unchanged at its March meeting, and since then, Jerome Powell had kept his speech intact: a forecast of three 25 basis point cuts in 2024, which would start to materialize in the second half of the year, but which could be delayed depending on how the data evolves. However, the latest macro data published, with inflation surprising on the upside again and other economic indicators such as employment, ISM and PMIs beating analysts’ estimates, make it difficult to justify early rate cuts. At this time, the market is discounting a 50 basis point cut for 2024 through the swaps curve (at the end of 2023, more than 100 basis points were discounted for the whole of 2024).

In Europe, the European Central Bank Governing Council met last Thursday, April 11, and kept interest rates unchanged for the fifth consecutive month. As we have commented, the situation in Europe is quite different from that in the United States, as we are in an environment of low economic growth and already with inflation quite controlled, so it seems clear that the ECB is going to anticipate the Fed in terms of interest rate cuts. In fact, several ECB members pointed to the possibility of having lowered rates as early as the April meeting, although the official speech gives a significant probability that the first move will be seen at the June meeting.

Finally, last week the long-awaited US earnings season began, which will undoubtedly be one of the catalysts for the financial markets in the coming days. The major US banks disappointed analysts with the exception of Citigroup, which slightly beat estimates. Wells Fargo and JP Morgan Chase, on the other hand, reported lower-than-expected revenue figures, with lower profits due to rising costs.

Spotlight on markets:

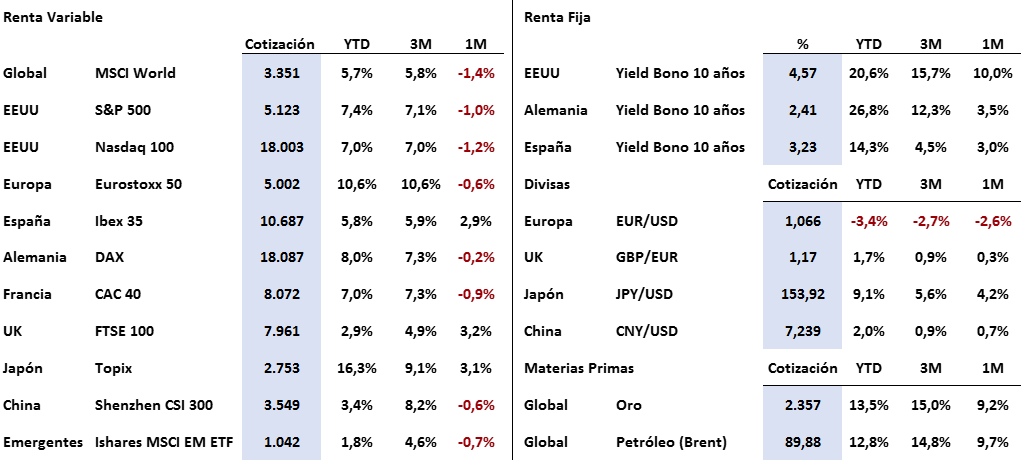

We are halfway through the month with the markets reflecting the growing tension in the Middle East but for now without giving a high probability to a significant and long-lasting deterioration, giving the feeling that unfortunately the markets have become accustomed to cohabiting with the uncertainty generated by armed conflicts.

The main stock markets lost between -0.60% for the Nasdaq 100 and -2.10% for the Ibex 35 last week. For their part, the benchmark indices in the US and Europe fell 1.55% (S&P 500) and 1.20% (Eurostoxx 50) respectively. It is worth noting that the S&P 500’s Friday session was the worst performance since the beginning of January. On the other hand, the falls in Asian stock markets have pushed the region’s indices to their lowest levels in six weeks.

The performance of bonds was mixed between the US and Europe. The US 10-year Treasury note rose 12 basis points to end the week at 4.50% after hitting an annual high of 4.58%. In Europe, German and Spanish debt saw their yields fall by 5 basis points to end the week at 2.36% and 3.19% respectively, despite the growing geopolitical risks. The explanation for this different behavior lies in the US CPI data published last week, which, as we have commented, suggest that interest rates in the US will remain high for longer than previously thought.

As for commodities, gold has once again started a week with gains after setting a new all-time high of $2,431/oz and closing at $2,343, up 0.6% from the previous week. Oil, on the other hand, fell at the beginning of the week despite the increase in hostilities in Israel, as the market had already priced in the event.

On the macro side, it is worth highlighting, apart from the strength of the US CPI, that the Chinese economy continues to show weakness, with CPI data (a drop from 0.7% to 0.4% was expected, and finally 0.1% was published) and its trade balance data falling significantly short of market expectations.

The quote:

We close with the following quote from Indian politician Mahatma Gandhi: «Earth provides enough to satisfy every man’s need, but not every man’s greed.»

Summary of the performance of the main financial assets (15/04/2024)

Disclaimer

This report does not provide personalized financial advice. It has been prepared independently of the specific financial circumstances and objectives of the individuals who receive it.

This document has been prepared by Portocolom Agencia de Valores S.A. for the purpose of providing general information as of the date of issue of the report and is subject to change without notice. Portocolom Agencia de Valores S.A. assumes no obligation to communicate such changes or to update the content of this document. Neither this document nor its content constitutes an offer, invitation or solicitation to purchase or subscribe for securities or other instruments or to make or cancel investments, nor may it be used as the basis for any contract, commitment or decision of any kind.

The information contained in this report has been obtained from public sources and is considered reliable. Although reasonable care has been taken to ensure that the information contained in this document is not inaccurate or misleading at the time of publication, we do not represent that it is accurate and complete and it should not be relied upon as such. Portocolom Agencia de Valores S.A. assumes no responsibility for any loss, direct or indirect, that may result from the use of the information provided in this report. Past performance of variables may not be a good indicator of their future performance.